Advance Auto Parts 2014 Annual Report Download - page 56

Download and view the complete annual report

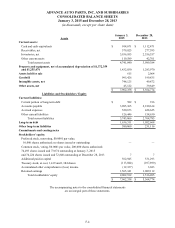

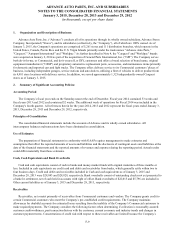

Please find page 56 of the 2014 Advance Auto Parts annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.ADVANCE AUTO PARTS, INC. AND SUBSIDIARIES

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

January 3, 2015, December 28, 2013 and December 29, 2012

(in thousands, except per share data)

F-9

1. Organization and Description of Business:

Advance Auto Parts, Inc. (“Advance”) conducts all of its operations through its wholly owned subsidiary, Advance Stores

Company, Incorporated (“Stores”), and its subsidiaries (collectively, the “Company”), all of which are 100% owned. As of

January 3, 2015, the Company's operations are comprised of 5,261 stores and 111 distribution branches, which operate in the

United States, Canada, Puerto Rico and the U.S. Virgin Islands primarily under the trade names “Advance Auto Parts,”

"Carquest," "Autopart International" and "Worldpac." As further described in Note 4, the "Carquest" and "Worldpac" brands

were acquired on January 2, 2014 as part of the acquisition of General Parts International, Inc. ("GPI"). The Company serves

both do-it-for-me, or Commercial, and do-it-yourself, or DIY, customers and offers a broad selection of brand name, original

equipment manufacturer ("OEM") and proprietary automotive replacement parts, accessories, and maintenance items primarily

for domestic and imported cars and light trucks. The Company offers delivery service to its Commercial customers’ places of

business, including independent garages, service stations and auto dealers, utilizing a fleet of vehicles to deliver product from

its 4,981 store locations with delivery service. In addition, we served approximately 1,325 independently-owned Carquest

stores as of January 3, 2015.

2. Summary of Significant Accounting Policies:

Accounting Period

The Company’s fiscal year ends on the Saturday nearest the end of December. Fiscal year 2014 contained 53 weeks and

fiscal years 2013 and 2012 each contained 52 weeks. The additional week of operations for Fiscal 2014 was included in the

Company's fourth quarter. All references herein for the years 2014, 2013 and 2012 represent the fiscal years ended January 3,

2015, December 28, 2013 and December 29, 2012, respectively.

Principles of Consolidation

The consolidated financial statements include the accounts of Advance and its wholly owned subsidiaries. All

intercompany balances and transactions have been eliminated in consolidation.

Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and

assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the

date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results

could differ materially from those estimates.

Cash, Cash Equivalents and Bank Overdrafts

Cash and cash equivalents consist of cash in banks and money market funds with original maturities of three months or

less. Included in cash equivalents are credit card and debit card receivables from banks, which generally settle within two to

four business days. Credit and debit card receivables included in Cash and cash equivalents as of January 3, 2015 and

December 28, 2013 were $28,843 and $28,828, respectively. Bank overdrafts consist of outstanding checks not yet presented to

a bank for settlement, net of cash held in accounts with right of offset. Bank overdrafts of $22,015 and $5,796 are included in

Other current liabilities as of January 3, 2015 and December 28, 2013, respectively.

Receivables

Receivables, net consist primarily of receivables from Commercial customers and vendors. The Company grants credit to

certain Commercial customers who meet the Company’s pre-established credit requirements. The Company maintains

allowances for doubtful accounts for estimated losses resulting from the inability of the Company’s Commercial customers to

make required payments. The Company considers the following factors when determining if collection is reasonably assured:

customer creditworthiness, past transaction history with the customer, current economic and industry trends and changes in

customer payment terms. Concentrations of credit risk with respect to these receivables are limited because the Company’s