Acer 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

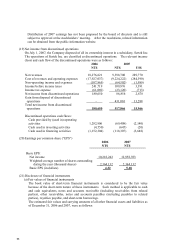

(d) Legal reserve, unappropriated earnings, and dividend policy

The Company’s articles of incorporation stipulate that at least 10% of annual net income

after deducting accumulated deficit, if any, must be retained as legal reserve until such

retention equals the amount of authorized common stock. In addition, a special reserve

should be set up in accordance with SFB regulations. The remaining balance of annual net

income, if any, can be distributed as follows:

y at least 5% as employee bonuses; employees may include subsidiaries’ employees that

meet certain criteria set by the board of directors;

y 1% as remuneration for directors and supervisors; and

y the remainder, after retaining a certain portion for business considerations, as dividends

and bonuses for stockholders.

Since the Company operates in an industry experiencing rapid change and development,

distribution of earnings shall be made in view of the year’s earnings, the overall economic

environment, the related laws and decrees, and the Company’s long-term development and

steady financial position. The Company has adopted a steady dividend policy, in which a

cash dividend comprises at least 10% of the total dividend distributed.

According to the ROC Company Act, the legal reserve can be used to offset an accumulated

deficit and may be distributed in the following manner: (i) when it reaches an amount equal

to one-half of the paid-in capital, it can be transferred to common stock at the amount of

one-half of legal reserve; and (ii) when it reaches an amount exceeding one-half of the

authorized common stock, dividends and bonuses can be distributed from the excess portion

of the legal reserve.

Beginning in 2000, pursuant to SFB regulations, an amount equal to the total amount of any

deduction items of shareholders’ equity shall be provided from the net income of the current

year as a special reserve that cannot be distributed as dividend or bonus. Accordingly,

such special reserve shall be adjusted to reflect the changes in the deduction items. Any

reversal of the special reserve can be added back to unappropriated earnings for distribution

of dividends or bonus. As of December 31, 2006, the Company retained a special reserve

of NT$283,921, to cover the amount by which treasury stock cost was below market value

and other deduction items of stockholders’ equity. Such special reserve was reversed in

2007.

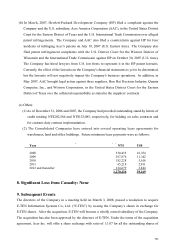

The appropriation of 2005 and 2006 earnings was approved by the shareholders at meetings

on June 15, 2006, and June 14, 2007, as follows:

2005 2006

NT$ NT$

Dividend per share

Cash 3.0 3.85

Stock 0.2 0.15

3.2 4.00

Employee bonus.stock (par value) 374,546 333,708

Employee bonus.cash 374,546 424,719

Directors’ and supervisors’ remuneration 93,637 94,803

842,729 853,230

The appropriation of earnings did not differ from the resolutions approved by the

Company’s directors.

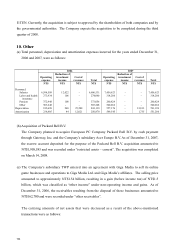

Assuming the above employee bonus and directors’ and supervisors’ remuneration are paid

in cash and expensed in the year when the earnings are recognized, the earnings per share,

not computed retroactively, for 2005 and 2006 would be reduced from NT$3.83 and

NT$4.45 to NT$3.45 and NT$4.08, respectively. Stock dividends distributed to employees

represented 1.66% and 1.43% of the outstanding common shares as of December 31, 2005

and 2006, respectively.