Acer 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

87

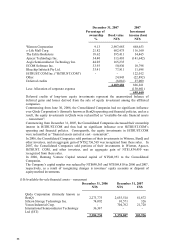

The Company sold all its ownership interest in a subsidiary, Sertek Inc., on July 1, 2007.

The price included cash consideration and stock consideration amounting to 27,000,000

shares of Yosun Industrial Corp.

In 2006, the Consolidated Companies sold portions of their investments in RDC and other

investees, and an aggregate gain of NT$98,124 was recognized from these sales. In 2007,

the Consolidated Companies sold portions of their investments in Qisda, Silicon and IST, and

an aggregate gain of NT$109,491 was recognized from these sales.

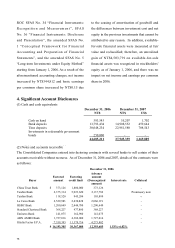

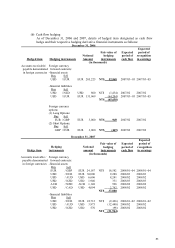

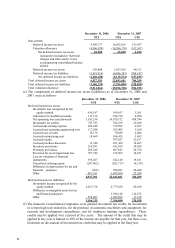

(11) Property not used in operations

December 31, 2006 December 31, 2007

NT$ NT$ US$

Leased assetsЁland 818,630 818,630 25,239

Leased assetsЁbuildings 2,892,886 2,855,547 88,039

Damaged office premises 457,558 457,558 14,107

Property held for sale and development 2,814,503 1,761,173 54,299

Less: Accumulated depreciation (543,769) (543,805) (16,766)

Accumulated asset impairment (1,543,000) (1,543,000) (47,572)

4,896,808 3,806,103 117,346

In 2006, the Company decided to gradually dispose of real estate property and business

managed by the Construction Business Unit, and as a result, the related property amounting to

NT$3,288,806 was reclassified from “property, plant and equipment” to “property not used in

operations” in the accompanying balance sheets. In 2006, the Consolidated Companies

recognized an impairment loss of NT$995,000 on property not used in operations, being the

carrying value in excess of the estimated fair value.

Damaged office premises are office premises that suffered fire damage. As of December 31,

2006 and 2007, the Consolidated Companies estimated the building repair cost at

approximately NT$116,308 and NT$161,308, respectively, which will not be indemnified by

the insurance company. A provision for building repair cost was accrued and recognized as

“other current liabilities” in the accompanying consolidated balance sheets.

For certain land acquired, the registered ownership has not been transferred to the land

acquirer, APDI, a subsidiary of the Company. To protect APDI’s interests, APDI has

obtained signed contracts from the titleholders assigning all rights and obligations related to

the land to APDI. Additionally, the land title certificates are held by APDI, and APDI has

registered its liens thereon.

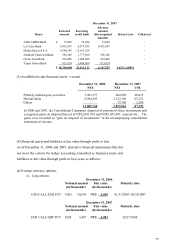

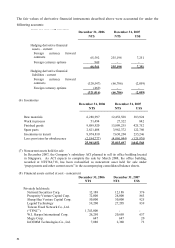

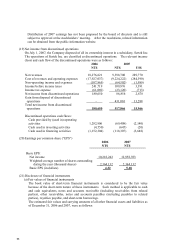

(12) Intangible assets

Goodwill Software

System Patents Trademarks Customer

Relationships Others Total

NT$ NT$ NT$ NT$ NT$ NT$ NT$

Balance at January 1, 2006 306,616 194,747 515 - - - 501,878

Additions - 69,896 - - - 3,408 73,304

Disposal - - (480) - - - (480)

Translation adjustment 8,282 5,802 177 - - - 14,261

Amortization (63,091) (121,670) (41) - - - (184,802)

Impairment loss (7,479) - - - - - (7,479)

Balance at December 31, 2006 244,328 148,775 171 - - 3,408 396,682

Additions - 74,114 415,701 - - 4,054 493,869

Acquisitions 16,654,264 - 1,116,481 5,504,220 1,551,042 570,729 25,396,736

Disposal - (2) (120) - - (3,408) (3,530)

Translation adjustment (7,876) 2,062 553 73 494 1,294 (3,400)

Amortization - (142,446) (59,074) (6,054) (40,457) (105,833) (353,864)

Balance at December 31, 2007 16,890,716 82,503 1,473,712 5,498,239 1,511,079 470,244 25,926,493