Acer 2007 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

86

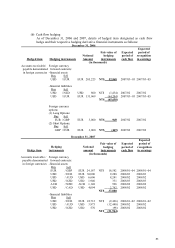

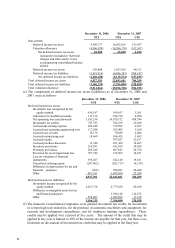

December 31, 2007 2007

Percentage of

ownership Book value

Investment

income (loss)

% NT$ NT$

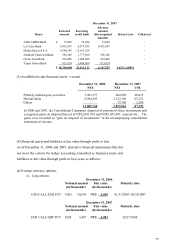

Wistron Corporation 9.13 2,987,685 668,653

e-Life Mall Corp. 21.82 682,475 116,160

The Eslite Bookstore 18.62 395,411 34,465

Apacer Technology Inc. 34.40 313,410 (141,642)

Aegis Semiconductor Technology Inc. 44.03 165,235 -

ECOM Software Inc. 33.93 50,830 10,798

Bluechip Infotech Pty Ltd. 33.41 77,811 11,698

HiTRUST.COM Inc. (“HiTRUST.COM”) - - 122,012

Other 24,843 (22,892)

Deferred credits (8,016) 27,009

4,689,684 826,261

Less: Allocation of corporate expense (130,601)

695,660

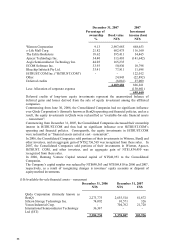

Deferred credits of long-term equity investments represent the unamortized balance of

deferred gains and losses derived from the sale of equity investment among the affiliated

companies.

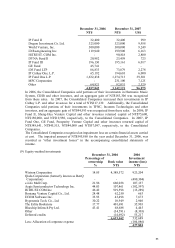

Commencing from June 30, 2006, the Consolidated Companies had no significant influence

over Qisda Corporation’s (formerly known as BenQ) operating and financial policies, and as a

result, the equity investments in Qisda were reclassified as “available-for-sale financial assets

Ёnoncurrent”.

Commencing from December 31, 2007, the Consolidated Companies decreased their ownership

interest in HiTRUST.COM and thus had no significant influence over HiTRUST.COM’s

operating and financial policies. Consequently, the equity investments in HiTRUST.COM

were reclassified as “financial assets carried at costЁnoncurrent”.

In 2006, the Consolidated Companies sold portions of their investments in Wistron, BenQ and

other investees, and an aggregate gain of NT$2,736,565 was recognized from these sales. In

2007, the Consolidated Companies sold portions of their investments in Wistron, Apacer,

HiTRUST. COM, and other investees, and an aggregate gain of NT$1,834,450 was

recognized from these sales.

In 2006, Hontang Venture Capital retuned capital of NT$48,951 to the Consolidated

Companies.

The Company’s capital surplus was reduced by NT$698,363 and NT$169,810 in 2006 and 2007,

respectively, as a result of recognizing changes is investees’ equity accounts or disposal of

equity-method investments.

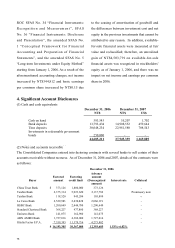

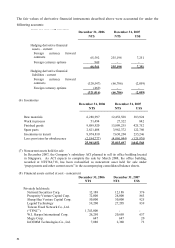

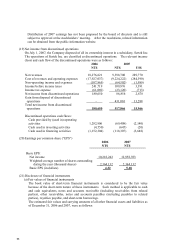

(10) Available-for-sale financial assetsЁnoncurrent

December 31, 2006 December 31, 2007

NT$ NT$ US$

Qisda Corporation (formerly known as

BenQ) 2,273,775 2,655,514 81,872

Silicon Storage Technology Inc. 74,092 10,571 326

Yosun Industrial Corp. - 704,762 21,728

International Semiconductor Technology

Ltd. (IST)

36,367 -

-

2,384,234 3,370,847 103,926