Acer 2007 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

82

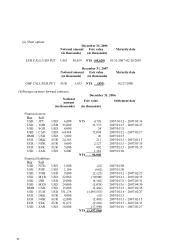

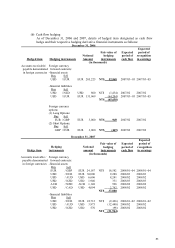

December 31, 2006

Hedged item

Hedging

instruments Notional amount

Fair value of

hedging

instruments Settlement date

(in thousands)

Foreign currency

forward contracts:

-financial assets

Buy Sell

Accounts receivable/

payable denominated

in foreign currencies

EUR / GBP EUR 108,000 NT$ 11,516 2007/01/31 ~ 2007/03/30

USD / AUD USD 11,835 1,208 2007/03/30 ~ 2007/04/30

NT$ 12,724

-financial liabilities

Buy Sell

USD / EUR EUR 153,392 NT$ (206,676) 2007/01/16 ~ 2007/03/15

EUR / GBP EUR 39,000 (3,975) 2007/01/31 ~ 2007/03/30

USD / AUD USD 53,783 (36,884) 2007/01/18 ~ 2007/04/17

USD / NZD USD 3,700 (7,374) 2007/01/18 ~ 2007/03/16

NT$ (254,909)

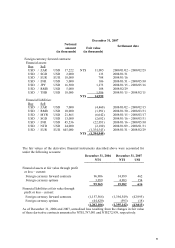

December 31, 2007

Hedged item

Hedging

instruments Notional amount

Fair value of

hedging

instruments Settlement date

(in thousands)

Foreign currency

forward contracts:

-financial assets

Buy Sell

Accounts receivable/

payable denominated

in foreign currencies

EUR / NOK EUR 9,000 NT$ 7,450 2008/01/15

EUR / SEK EUR 8,500 8,813 2008/01/15

EUR / GBP EUR 146,410 131,615 2008/01/31 ~ 2008/04/16

USD / EUR EUR 13,566 6,268 2008/02/29

USD / AUD USD 29,897 42,826 2008/01/16 ~ 2008/02/28

USD / NZD USD 2,000 98 2008/01/30

AUD / NZD AUD 632 328 2008/02/05

NT$ 197,398

Financial liabilities

Buy Sell

USD / EUR EUR 11,388 NT$ (21,804) 2008/01/01 ~ 2008/02/29

USD / AUD USD 9,790 (22,773) 2008/01/11 ~ 2008/01/31

USD / NZD USD 1,430 (245) 2008/02/29

AUD / NZD AUD 1,751 - 2008/01/07

NT$ (44,822)

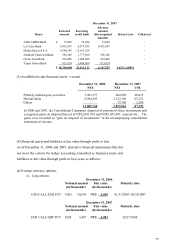

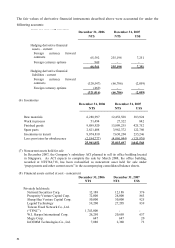

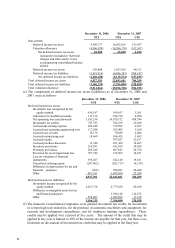

(5) Hedging derivative nancial assets and liabilities

The Consolidated Companies entered into foreign currency forward contracts and foreign currency

options to hedge their exposure to changes in cash ows associated with foreign currency exchange

risk resulting from anticipated transactions denominated in foreign currencies.

(a) Fair value hedge

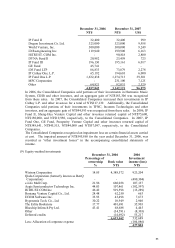

As

of December 31, 2006 and 2007, details of hedged items designated as fair value hedges and

their respective hedging derivative nancial instruments were as follows: