Acer 2007 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.73

level goodwill. Investor-level goodwill is no

longer amortized but tested for impairment.

Differences between investment cost and

net equity of the investee in the previous

investments that cannot be attributed to any

reason and were originally amortized over five

years are no longer amortized starting from

January 1, 2006.

When an equity-method investment is disposed

of, the difference between the selling price and

the book value of the equity-method investment

is recognized as disposal gain or loss in the

accompanying consolidated statements of

income. If there are capital surplus and separate

components of shareholders’ equity resulting

from such equity investments, they are charged

as a reduction to disposal gain/loss based on the

disposal ratio of investments.

If an investee company issues new shares and

the Company does not acquire new shares in

proportion to its original ownership percentage,

the Company’s equity in the investee’s net

assets will be changed. The change in the

equity interest shall be used to adjust the capital

surplus and long-term investment accounts. If

the Company’s capital surplus is insufficient to

offset the adjustment to long-term investment,

the difference is charged as a reduction to

retained earnings.

Unrealized gains and losses resulting from

transactions between the Consolidated

Companies and investees accounted for under

the equity method are deferred to the extent of

the Company’s ownership. The gains and losses

resulting from depreciable or amortizable assets

are recognized over the estimated useful lives of

such assets. Gains and losses from other assets

are recognized when realized.

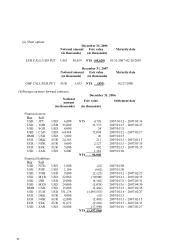

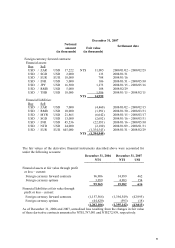

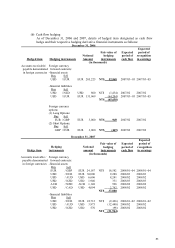

(l) Capital leases

For capital leases, where the Consolidated

Companies act as the lessor, the Consolidated

Companies account for all installment rental

receivables plus bargain purchase price or

guaranteed residual value and their related

imputed interest as lease receivables and

recognize interest income thereon over the lease

terms.

(m) Property, plant and equipment, property

leased to others, and property not used in

operations

Property, plant and equipment are stated at

acquisition cost. Interest expense related to the

purchase and construction of property, plant

and equipment is capitalized and included in the

cost of the related asset. Significant renewals,

improvements and replacements are capitalized.

Maintenance and repair costs are charged to

expense as incurred. Gains and losses on the

disposal of property, plant and equipment are

recorded in the non-operating section in the

accompanying consolidated statements of

income.

Land held for the purpose of development and

future sale are recorded under “property not