Acer 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

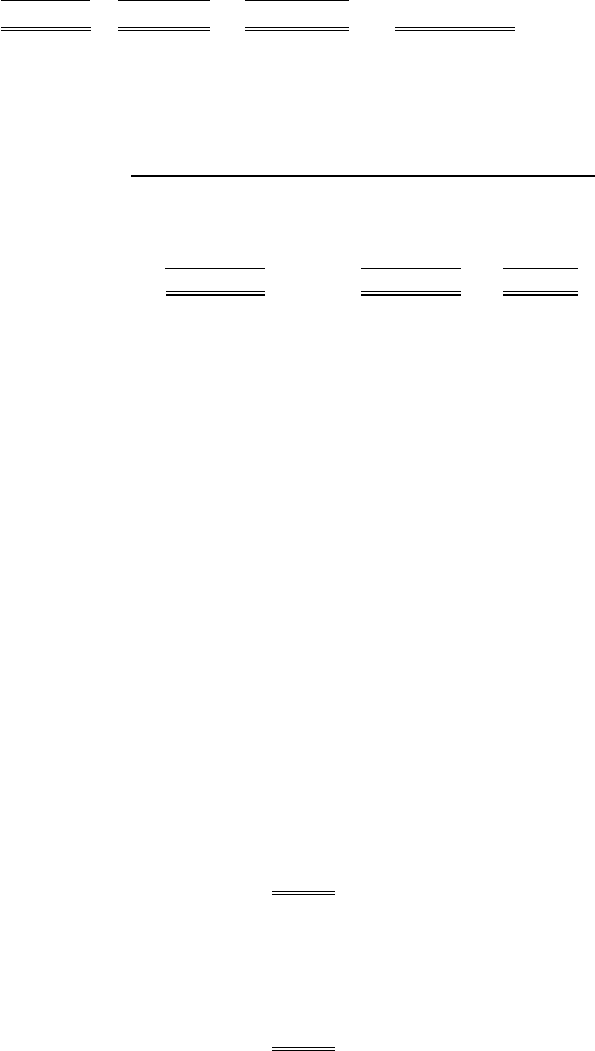

79

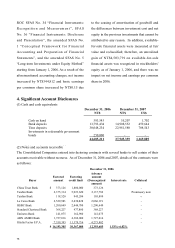

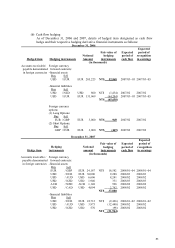

December 31, 2007

Buyer

Factored

amount

Factoring

credit limit

Advance

amount

(Derecognized

amount)

Interest rate Collateral

ABN AMRO Bank $ 72,068 72,068 72,068 -

La Caixa Bank 4,415,967 6,577,855 4,415,967 -

Ifitalia Factor S.P.A. 4,598,145 12,183,229 - -

Standard Chartered Bank 596,346 1,777,960 596,346 -

China Trust Bank 254,498 1,800,000 254,498 -

Taipei Fubon Bank 823,824 1,000,000 823,824 -

$ 10,760,848 23,411,112 6,162,703 1.62%~6.00%

Ё

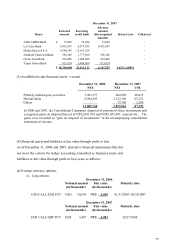

(3) Available-for-sale nancial assets-current

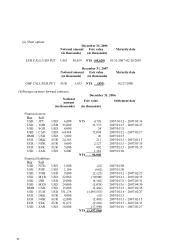

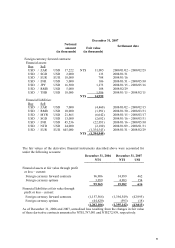

(4) Financial assets and liabilities at fair value through prot or loss

As of December 31, 2006 and 2007, derivative nancial instruments that did

not meet the criteria for hedge accounting (classied as nancial assets and

liabilities at fair value through prot or loss) were as follows:

(a) Foreign currency options:

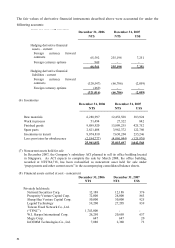

(3) Available-for-sale financial assetsЁcurrent

December 31, 2006 December 31, 2007

NT$ NT$ US$

Publicly traded equity securities 5,301,377 662,096 20,413

Mutual funds 8,504,383 2,112,196 65,121

Others - 77,769 2,398

13,805,760 2,852,061 87,932

In 2006 and 2007, the Consolidated Companies disposed of portions of these investments and

recognized gains on disposal thereof of NT$2,601,934 and NT$2,057,447, respectively. The

gains were recorded as “gain on disposal of investments” in the accompanying consolidated

statements of income.

(4) Financial assets and liabilities at fair value through profit or loss

Ё

(i) Long options:

December 31, 2006

Notional amount Fair value Maturity date

(in thousands) (in thousands)

USD CALL/EUR PUT USD 50,854 NT$ 3,059 01/31/2007~02/28/2007

December 31, 2007

Notional amount Fair value Maturity date

(in thousands) (in thousands)

EUR CALL/GBP PUT EUR 3,487 NT$ 4,983 02/27/2008