Acer 2007 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

101

- 94 -

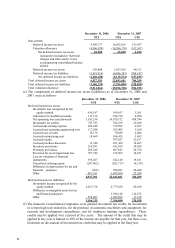

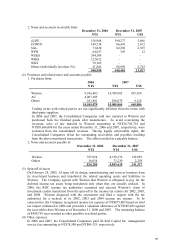

2. Notes and accounts receivable from:

December 31, 2006 December 31, 2007

NT$ NT$ US$

eLIFE 156,988 190,277 5,866

COWIN 149,738 86,676 2,672

SAL 73,020 82,230 2,535

WPH 64,837 395 12

WEKS 244,308 - -

WIKS 122,012 - -

WKS 78,165 - -

Others (individually less than 5%) 51,882 88,903 2,742

940,950 448,481 13,827

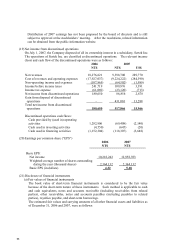

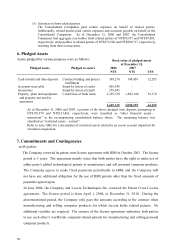

(2) Purchases and related notes and accounts payable

1. Purchases from:

2006 2007

NT$ NT$ US$

Wistron 9,936,483 14,788,985 455,958

AU 4,067,105 - -

Others 101,491 296,079 9,128

14,105,079 15,085,064 465,086

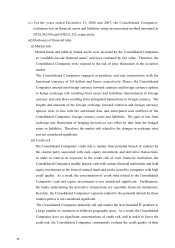

Trading terms with related parties are not significantly different from the terms with

third-party suppliers.

In 2006 and 2007, the Consolidated Companies sold raw material to Wistron and

purchased back the finished goods after manufacture. To avoid overstating the

revenues, sales of raw material to Wistron amounting to NT$36,730,724 and

NT$58,666,096 for the years ended December 31, 2006 and 2007, respectively, were

excluded from the consolidated revenues. Having legally enforceable rights, the

Consolidated Companies offset the outstanding receivables and payables resulting

from the above-mentioned transactions. The offset resulted in a payable balance.

2. Notes and accounts payable to:

December 31, 2006 December 31, 2007

NT$ NT$ US$

Wistron 787,654 4,510,376 139,059

Others 36,634 73,239 2,258

824,288 4,583,615 141,317

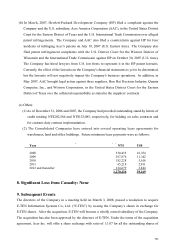

(3) Spin-off of assets

On February 28, 2002, AI spun off its design, manufacturing and services business from

its Acer-brand business and transferred the related operating assets and liabilities to

Wistron. The Company agreed with Wistron that Wistron is obligated to pay for the

deferred income tax assets being transferred only when they are actually utilized. In

2006, the ROC income tax authorities examined and rejected Wistron’s claim of

investment credits transferred from the spin-off in the income tax returns for 2002, 2003,

and 2004. Wistron disagreed with the assessment and filed a request with the tax

authorities for a recheck of its 2002, 2003 and 2004 income tax returns. To be

conservative, the Company recognized income tax expense of NT$875,802 based on total

tax impact estimated in 2006 and provided a valuation allowance of NT$385,043 against

the receivables from Wistron as of December 31, 2006 and 2007. The remaining balance

of $490,759 was recorded as other payables to related parties.

(4) Other expenses

In 2006 and 2007, the Consolidated Companies paid iD Soft Capital Inc. management

service fees amounting to NT$78,500 and NT$69,333, respectively.