Acer 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

ROC SFAS No. 34 “Financial Instruments:

Recognition an d Measurement ”, SFAS

No. 36 “Financial Instruments: Disclosure

and Presentation”, the amended SFAS No.

1 “Conceptual Framework for Financial

Accounting and Preparation of Financial

Statements”, and the amended SFAS No. 5

“Long-term Investments under Equity Method”

starting from January 1, 2006. As a result of the

aforementioned accounting changes, net income

increased by NT$344,812 and basic earnings

per common share increased by NT$0.15 due

to the ceasing of amortization of goodwill and

the differences between investment cost and net

equity in the previous investments that cannot be

attributed to any reason. In addition, available-

for-sale financial assets were measured at fair

value and reclassified; therefore, an unrealized

gain of NT$4,503,791 on available-for-sale

nancial assets was recognized in stockholders’

equity as of January 1, 2006, and there was no

impact on net income and earnings per common

share in 2006.

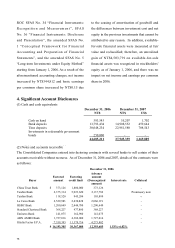

4. Signicant Account Disclosures

(1) Cash and cash equivalents

(1) Cash and cash equivalents

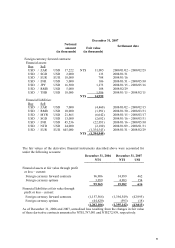

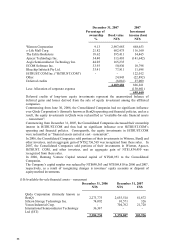

December 31, 2006 December 31, 2007

NT$ NT$ US$

Cash on hand 593,543 55,207 1,702

Bank deposits 13,793,434 14,908,552 459,644

Time deposits 30,048,234 22,981,580 708,543

Investments in redeemable government

bonds 250,000 - -

44,685,211 37,945,339 1,169,889

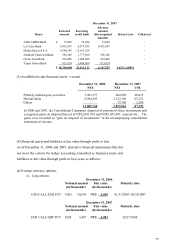

(2) Notes and accounts receivable

ϣ

(2) Notes and accounts receivable

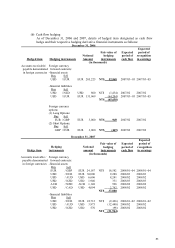

The Consolidated Companies entered into factoring contracts with several banks to sell certain of their

accounts receivable without recourse. As of December 31, 2006 and 2007, details of the contracts were

as follows:

the contracts were as follows:

December 31, 2006

Buyer

Factored

amount

Factoring

credit limit

Advance

amount

(Derecognized

amount)

Interest rate Collateral

China Trust Bank $ 373,126 1,800,000 373,126 -

Taishin Bank 2,375,314 5,923,620 2,137,782 Promissory note

Taishin Bank 118,520 945,284 105,889 ϣ

La Caixa Bank 2,529,983 2,430,828 2,066,119 -

HSBC Bank 1,200,649 2,444,700 1,200,649 -

Standard Chartered Bank 368,227 977,880 368,227 -

Emirates Bank 141,075 162,980 141,075 -

ABN AMRO Bank 1,727,016 4,302,000 1,727,016 -

Ifitalia Factor S.P.A. 7,359,395 11,379,716 4,273,802 -

$ 16,193,305 30,367,008 12,393,685 1.53%~6.02%