Acer 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

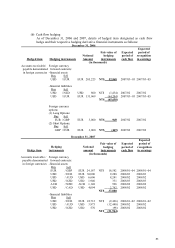

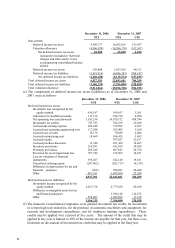

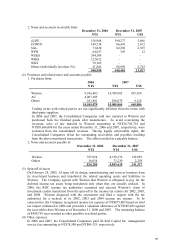

December 31, 2006 December 31, 2007

NT$ NT$ US$

Non-current:

Deferred income tax asset 4,589,737 16,652,016 513,397

Valuation allowance (4,506,829) (16,586,178) (511,367)

Net deferred income tax assetsЁ

noncurrent (included in “deferred

charges and other assets” in the

accompanying consolidated balance

sheets)

82,908 65,838 2,030

Deferred income tax assets 359,808 1,567,019 48,313

Deferred income tax liabilities (2,619,916) (6,686,393) (206,147)

Net deferred income tax liabilities (2,260,108) (5,119,374) (157,835)

Total deferred income tax assets 6,927,391 22,843,601 704,289

Total deferred income tax liabilities (3,186,235) (7,396,090) (228,028)

Total valuation allowance (5,511,961) (19,296,738) (594,935)

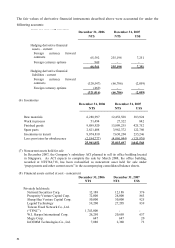

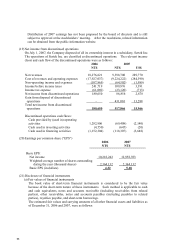

(e) The components of deferred income tax assets (liabilities) as of December 31, 2006 and

2007, were as follows:

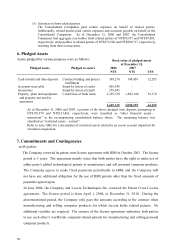

December 31, 2006 December 31, 2007

NT$ NT$ US$

Deferred income tax assets:

Investment loss recognized by the

equity method 939,187 109,017 3,361

Allowance for doubtful accounts 113,136 226,718 6,990

Net operating loss carryforwards 3,163,338 14,879,372 458,744

Investment tax credits 747,783 702,539 21,660

Accrued advertising expense 222,240 319,702 9,857

Accrued non-recurring engineering cost 117,298 102,485 3,160

Accrued cost of sales 74,179 78,029 2,406

Accrued restructuring cost 18,669 184,435 5,685

Accrued royalty - 707,627 21,817

Accrued purchase discounts 11,346 631,360 19,465

Inventory provisions 218,591 631,109 19,459

Warranty provisions 285,244 867,643 26,750

Provision for asset impairment loss 397,742 332,569 10,253

Loss on valuation of financial

instruments 395,487 622,140 19,181

Unrealized exchange gains (267,062) (201,717) (6,219)

Difference in depreciation for tax and

financial purposes (968) 954,883 29,440

Other 491,181 1,695,690 52,280

6,927,391 22,843,601 704,289

Deferred income tax liabilities:

Investment income recognized by the

equity method 2,627,738 2,777,678 85,638

Difference in intangible assets for tax

and financial purposes - 3,596,148 110,872

Other 558,497 1,022,264 31,518

3,186,235 7,396,090 228,028

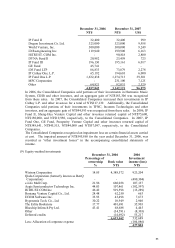

(f) The domestic Consolidated Companies were granted investment tax credits for investment

in certain high-tech industries, for the purchase of automatic machinery and equipment, for

research and development expenditures, and for employee training expenditures. These

credits may be applied over a period of five years. The amount of the credit that may be

applied in any year is limited to 50% of the income tax payable for that year, but there is no

limitation on the amount of investment tax credit that may be applied in the final year.