Acer 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

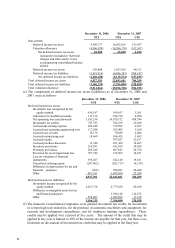

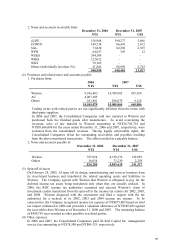

97

2006 2007

Fair value Fair value

Carrying

amount

Public quoted

price

Valuation

amount

Carrying

amount

Public quoted

price

Valuation

amount

NT$ NT$ NT$ NT$ NT$ NT$

Non-derivative financial instruments

Financial assets:

Available-for-sale financial assetsЁcurrent 13,805,760 13,805,760 - 2,852,061 2,852,061 -

Financial assets carried at cost 4,837,842 see below (b) see below (b) 3,142,121 see below (b) see below (b)

Available-for-sale financial assetsЁnoncurrent 2,384,234 2,384,234 - 3,370,847 3,370,847

Refundable deposits (classified as “other

financial assets”)

813,807 - 813,807 687,109 - 687,109

Noncurrent receivables (classified as “other

financial assets”)

480,537 - 480,537 274,284 - 274,284

Financial liabilities:

Long-term debt 168,627 - 168,627 16,790,876 - 16,790,876

Derivative financial instruments

Financial assets:

Foreign currency forward contracts 162,498 - 162,498 250,197 - 250,197

Foreign currency options 4,008 - 4,008 4,983 - 4,983

Financial liabilities:

Foreign currency forward contracts 1,478,113 - 1,478,113 1,461,335 - 1,461,335

Foreign currency options 45,089 - 45,089 593 - 593

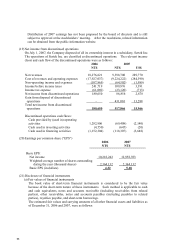

(b) The following methods and assumptions were used to estimate the fair value of each class

Ё

(b) The following methods and assumptions were used to estimate the fair value of each class of

nancial instruments:

(i) Available-for-sale nancial assets-current and noncurrent

Publicly quoted market prices are used as fair value.

(ii) Financial assets carried at cost

Financial assets carried at cost were privately held stock. The fair value of privately held

stock was unable to be determined because it was not traded in the public market.

(iii) Refundable deposits

The estimated fair value of refundable deposits is determined as the discounted present

value of expected future cash ows, which is similar to book value.

(iv) Noncurrent receivables

The fair values are their present value discounted at the market interest rate.

(v) Long-term debt

Long-term debt is obtained at oating interest rates which are calculated based on prevailing

market rate adjusted by the Company’s credit spread. The carrying value of long-term debt

approximates the market value.

(vi) Derivative nancial instruments

The fair values of the Consolidated Companies’ derivative financial instruments are

estimated using a valuation method. The assumptions used should be the same as those

used by nancial market traders when quoting their prices, which are readily available to the

Consolidated Companies.