Acer 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.71

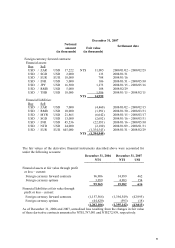

or loss. Financial instruments at fair value

through profit or loss are measured at fair

value, and changes therein are recognized in

prot or loss.

(2)Hedging derivative financial assets /

liabilities

Hedging derivative nancial assets / liabilities

represent derivatives that are to hedge the risk

of changes in exchange rates resulting from

operating activities denominated in foreign

currency and meet the criteria for hedge

accounting.

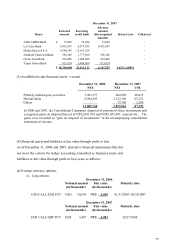

(3) Available-for-sale nancial assets

Available-for-sale financial assets are

measured at fair value, and any changes

are recognized directly in equity. The fair

value of publicly traded stocks is the closing

price at the balance sheet date. The fair

value of open-end mutual funds is based on

the net asset value of the mutual funds at

balance sheet date. When an investment is

derecognized, the cumulative unrealized gain

or loss in equity account is transferred to

profit or loss. If there is objective evidence

which indicates that a financial asset is

impaired, a loss is recognized in prot or loss.

If, in a subsequent period, events or changes

in circumstances indicate that the amount

of impairment loss decreases, reversal of a

previously recognized impairment loss for

equity securities is charged to equity; while

for debt securities, the reversal is allowed

through profit or loss provided that the

decrease is clearly attributable to an event

which occurred after the impairment loss is

recognized.

(4) Financial assets carried at cost

Equity investments which cannot be evaluated

at fair value are carried at original cost. If

there is objective evidence which indicates

that an equity investment carried at cost

has been impaired, a loss is recognized. A

subsequent reversal of such impairment loss

is not allowed.

(i) Derivative nancial instruments and hedging

activities

Hedge accounting recognizes the offsetting

effects on profit or loss of changes in the fair

values of the hedging instrument and the hedged

item. If the designated hedging instruments

meet the criteria for hedge accounting, they are

accounted for as follows :

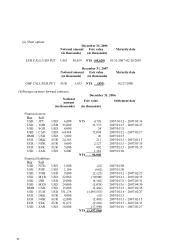

(1) Fair value hedges

Changes in the fair value of a hedging

instrument designated as a fair value hedge

are recognized in prot or loss. The hedged

item is also stated at fair value in respect of

the risk being hedged, with any gain or loss

being recognized in prot or loss.

(2) Cash ow hedges

Changes in the fair value of a hedging

instrument designated as a cash flow hedge

are recognized directly in equity. If a hedge

of a forecasted transaction subsequently

results in the recognition of an asset or a