Acer 2007 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

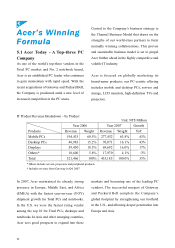

(2) Market Growth

According to Gartner Dataquest, global Total PC

shipments increased 13.8% YOY to reach 272.3

million units. The major growth driver came

from notebook PCs with 32.3% YOY growth,

far exceeding 4.2% for desktop PCs. Looking

ahead, Gartner predicts Total PC unit shipments

to grow by 10.9% in 2008 and 13.0% in 2009,

respectively; specifically, the notebook sector

is expected to maintain strong YOY growths

of 25.1% and 22.4% during the same period.

Further ahead, Gartner foresees a high possibility

of the notebook quantity to surpass desktop PCs

by 2010.

Additionally, Acer is targeting key emerging

markets that are generating rapid PC growth

momentum. These markets include Asia Pacic,

Greater China, Latin America, Eastern Europe,

Middle East and Africa.

For converged mobile devices (CMD), total

shipments exceeded 125 million units in 2007

with 52.8%YOY growth, according to IDC. By

2011, IDC predicts that total shipments will hit

314 million units, reaching 30.9% in compound

annual growth rate (CAGR). Western Europe

will emerge as the leading region, followed by

the U.S. and Asia Pacic. Meanwhile, the market

share of Microsoft Windows®-based operating

systems will increase from 10.7% in 2007, to

19.3% in 2011; although Symbian’s operating

system will still dominate the market through to

2011 by more than 50% share.

5.4 The Four Pillars of Success

Acer’s “four pillars of success” are the foundations for our continuing advancement and further success

in the IT industry:

Acer’s “four pillars of success” are the foundations for our continuing advancement and

•