Acer 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

As of December 31, 2007, the Company had issued 10,800,000 units of global depository

receipts (GDRs) representing 54,000,000 shares of common stock. The GDRs were listed

on the London Stock Exchange, and each GDR represents five shares of common stock.

The Company’s shareholders in the meeting on June 15, 2006, passed a resolution to

appropriate NT$3.0 per share from retained earnings as of December 31, 2005, as cash

dividends. Such cash dividends amounted to NT$6,763,556. The shareholders also

passed a resolution to appropriate NT$825,450 from retained earnings for a total of

82,545,000 new shares as stock dividends and employee bonuses. The stock issuance was

authorized by and registered with the governmental authorities.

The Company’s shareholders in the meeting on June 14, 2007, passed a resolution to

appropriate NT$3.85 per share from retained earnings as of December 31, 2006, as cash

dividends. Such cash dividends amounted to NT$8,997,695. The shareholders also

passed a resolution to appropriate NT$684,267 from retained earnings and issue a total of

68,427,000 new shares as stock dividends and employee bonuses. The stock issuance was

authorized by and registered with the governmental authorities.

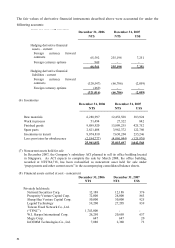

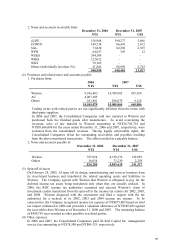

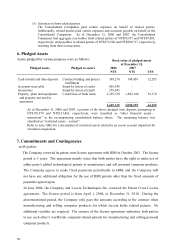

(b) Treasury stock

As of December 31, 2006 and 2007, the GDRs (for the implementation of its overseas

employees’ stock option plan) owned by AWI and the common stock owned by the

Company’s subsidiaries CCI and TWP were as follows (expressed in thousands of shares

and New Taiwan dollars):

December 31, 2006 December 31, 2007

Number of

Shares

Book

Value

Market

Price

Number of

Shares

Book

Value

Market

Price

NT$ NT$ NT$ NT$

Common stock 16,805 798,662 1,142,744 17,057 798,662 1,083,128

GDRs 4,788 2,472,258 1,595,170 4,860 2,472,258 1,655,241

3,270,920 2,737,914 3,270,920 2,738,369

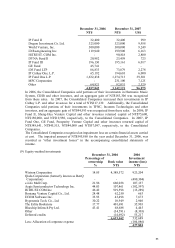

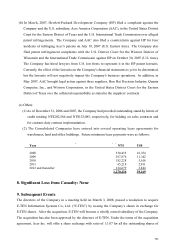

(c) Capital surplus

December 31, 2006 December 31, 2007

NT$ NT$ US$

Share premium:

Paid-in capital in excess of par value 856,901 856,901 26,419

Surplus from merger 22,781,719 22,781,719 702,381

Premium on common stock resulting from

conversion of convertible bonds

4,552,585 4,552,585 140,360

Forfeited interest resulting from conversion of

convertible bonds

1,006,210 1,006,210 31,022

Surplus related to the treasury stock

transactions by subsidiary companies

194,556 316,329 9,753

Other: ʳ ʳ

Surplus from equity-method investments 555,049 385,239 11,877

29,947,020 29,898,983 921,812

According to the ROC Company Act, any realized capital surplus could be transferred to

common stock as stock dividends after deducting accumulated deficit, if any. Realized

capital surplus includes share premium and donations from shareholders. Distribution of

stock dividends from realized capital surplus is subject to certain restrictions imposed by the

governmental authorities.