Acer 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

- 82 -

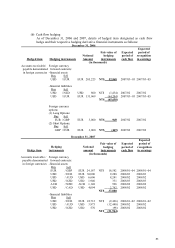

For the years ended December 31, 2006 and 2007, amortization of intangible assets amounted

to NT$184,802 and NT$353,864, respectively, and was recognized under operating expenses.

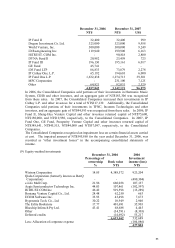

On October 15, 2007, the Company completed the acquisition of 100% ownership of Gateway,

Inc., a personal computer company in the U.S., through its indirectly wholly owned subsidiary

AAH at a price of US$1.90 (dollars) per share. The total purchase price amounted to

US$711,420 thousand.

The acquisition was accounted for in accordance with ROC SFAS No. 25 “Business

Combinations”. The Consolidated Companies recognized goodwill which represents the

excess of the purchase price and direct transaction cost of US$13,293 thousand over the fair

value of the net identifiable tangible and intangible assets.

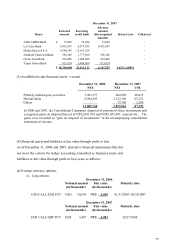

The following represents the allocation of the purchase price to the acquired net assets of

Gateway, Inc.:

NT$ NT$

Purchase Price: 23,507,016

The identifiable assets acquired and liabilities assumed:

Current assets 32,139,646

Investments carried at cost 277,057

Property, plant, and equipment 2,808,517

Intangible assetsЁtrademarks and trade names 5,504,220

Intangible assetsЁcustomer relationships 1,551,042

Intangible assetsЁothers 1,687,210

Other assets 58,355

Current liabilities (24,576,616)

Long-term liabilities (9,673,377)

Other liabilities (2,923,302) 6,852,752

Goodwill 16,654,264

The Gateway trademark and trade name have an indefinite life, and accordingly, are not

subject to amortization. The eMachine trademark and trade name are being amortized using

the straight-line method over 20 years, the estimated period in which the economic benefits

will be consumed. Customer relationships are being amortized using the straight-line

method over the estimated useful life of 10 years.

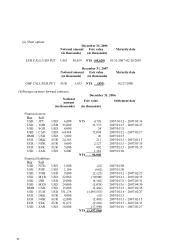

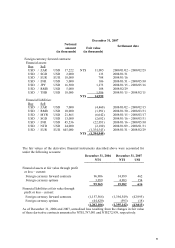

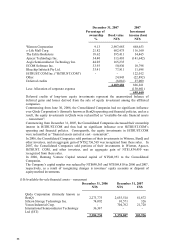

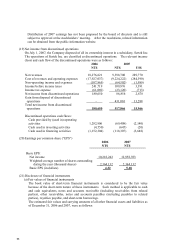

The following unaudited pro forma consolidated results of operations assume that the

acquisition of Gateway, Inc. was completed as of January 1 for each of the fiscal years shown

below.

2006 2007

NT$ NT$ US$

Revenues 451,202,888 531,041,545 16,372,485

Consolidated net income from continuing

operations before income tax 16,229,757 16,023,724 494,026

Consolidated net income from continuing

operations after income tax 13,635,814 13,086,851 403,479

Basic earnings per common share (in dollars) 5.77 5.54 0.17

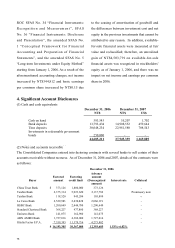

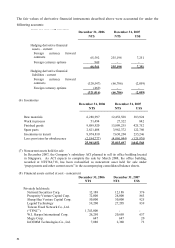

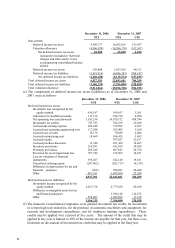

(13) Other financial assetsЁnoncurrent

December 31, 2006 December 31, 2007

NT$ NT$ US$

Refundable deposits 813,807 687,109 21,185

Noncurrent receivables 480,537 274,284 8,456

1,294,344 961,393 29,641