Acer 2007 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

5.3 Embracing New Mega Markets

Growth, scale and globalization are the answers

to reaching Acer’s next goals. Our market-

intelligence team explores and identifies

opportunities that are sustainable and protable

for our stakeholders, i.e. what is the next mega

market to emerge? Acer’s basic – yet effective

– principle calls for extensive market study;

only when the research data conrms a potential

mainstream market, will we allocate investments

with the confidence of achieving commercial

success and reward.

Acer saw the opportunity to own high-value

brands through the acquisitions of Gateway

and Packard Bell, which effectively create new

synergies from increased scale and efciencies.

The new multi-brand strategy enables Acer to

strategically position itself into different markets,

by geography and by customer segment.

Acer expects the global Total PC market to

continue double-digit growth over the next

three years, and notebooks rising by 20~25%.

The escalating convergence of mobile PCs and

communication devices will shape new ultra

mobile devices (UMD). The concept of the

UMD is its compactness, light weight, wireless

communication, without sacricing on essential

PC features. We also see demand for intensive

gaming machines, home theaters and multimedia

content sharing via a media gateway.

There are also new opportunities in prominent

emerging markets – such as Brazil, Russia, India

and China, in addition to Japan – as result of

rapid economic growth in these countries.

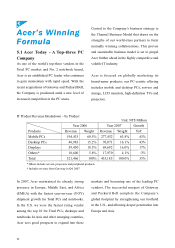

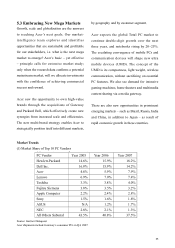

Market Trends

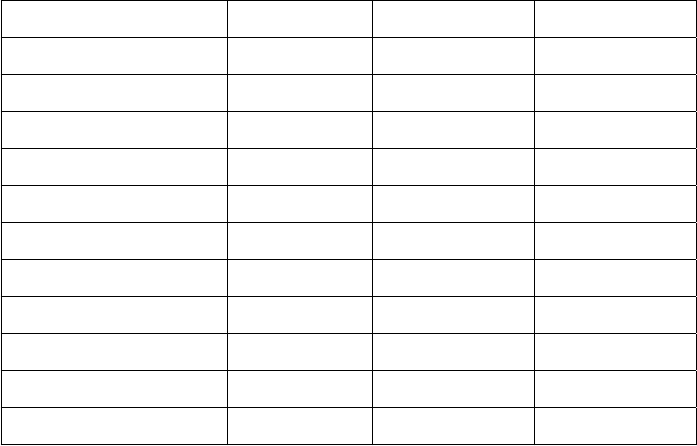

(1) Market Share of Top 10 PC Vendors

Source: Gartner Dataquest

Acer shipments include Gateway’s consumer PCs in Q4, 2007

(1) Market Share of Top 10 PC Vendors

PC Vendor Year 2005 Year 2006 Year 2007

Hewlett-Packard 14.6% 15.9% 18.2%

Dell Inc. 16.8% 15.9% 14.2%

Acer 4.6% 5.9% 7.9%

Lenovo 6.9% 7.0% 7.4%

Toshiba 3.3% 3.8% 4.0%

Fujitsu Siemens 3.8% 3.5% 3.2%

Apple Computer 2.2% 2.4% 2.8%

Sony 1.5% 1.6% 1.8%

ASUS N/A 1.2% 1.7%

NEC 2.8% 2.1% 1.3%

All Others Subtotal 43.5% 40.8% 37.5%

Source: Gartner Dataquest