Acer 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

85

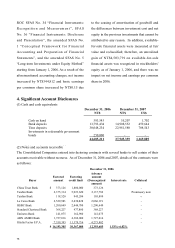

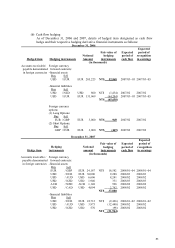

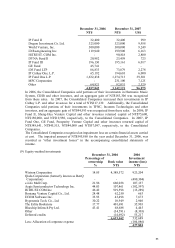

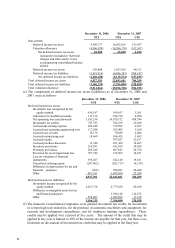

December 31, 2006 December 31, 2007

NT$ NT$ US$

IP Fund II 32,400 32,400 999

Dragon Investment Co. Ltd. 323,000 323,000 9,958

World Venture, Inc. 300,000 300,000 9,249

iD Reengineering Inc. 119,940 199,900 6,163

HiTRUST. COM Inc. - 90,818 2,800

DYNA Fund II 20,982 23,459 723

IP Fund III 196,130 195,161 6,017

GE Fund 45,741 - -

iD5 Fund LTP 86,833 73,879 2,278

IP Cathay One, L.P. 65,192 194,610 6,000

IP Fund One L.P. 1,632,438 1,274,713 39,301

MPC Corporation - 231,100 7,125

Other 64,821 82,031 2,529

4,837,842 3,142,121 96,875

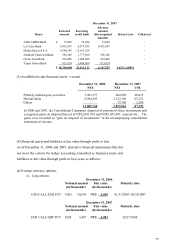

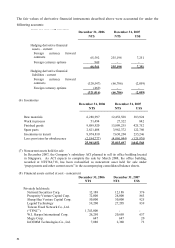

In 2006, the Consolidated Companies sold portions of their investments in Harmonix Music

System, CDIB and other investees, and an aggregate gain of NT$183,306 was recognized

from these sales. In 2007, the Consolidated Companies increased their investments in IP

Cathay L.P. and other investees for a total of NT$217,139. Additionally, the Consolidated

Companies sold portions of their investments in TFNC, Incomm Technologies and other

investees, and an aggregate gain of NT$44,593 was recognized from these sales. In 2006, IP

Fund II, Sheng-Hua Venture Capital and other investees returned capital of NT$75,600,

NT$150,000, and NT$19,950, respectively, to the Consolidated Companies. In 2007, IP

Fund One, GE Fund, Prosperity Venture Capital and other investees returned capital of

NT$348,641, NT$45,515, NT$44,000 and NT$57,097, respectively, to the Consolidated

Companies.

The Consolidated Companies recognized an impairment loss on certain financial assets carried

at cost. The impaired amount of NT$545,868 for the year ended December 31, 2006, was

recorded as “other investment losses” in the accompanying consolidated statements of

income.

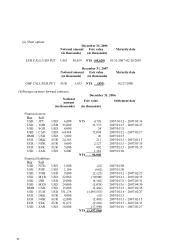

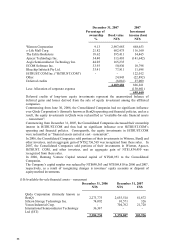

(9) Equity-method investments

December 31, 2006 2006

Percentage of

ownership Book value

Investment

income (loss)

% NT$ NT$

Wistron Corporation 14.85 4,388,572 923,204

Qisda Corporation (formerly known as BenQ

Corporation) -- (480,304)

e-Life Mall Corp. 21.96 660,038 107,137

Aegis Semiconductor Technology Inc. 44.03 107,461 (102,597)

HiTRUST.COM Inc. 46.42 919,598 (13,289)

Hontang Venture Capital Co., Ltd. 24.48 62,250 663

ECOM Software Inc. 33.93 43,498 7,673

Hyperemia Tech. Co., Ltd 30.22 10,949 2,940

The Eslite Bookstore 17.77 401,691 35,903

Bluechip Infotech Pty Ltd. 43.41 68,688 4,445

Other (34,591) (8,303)

Deferred credits (14,692) 55,217

6,613,462 532,689

Less: Allocation of corporate expense (104,886)

427,803