Acer 2007 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

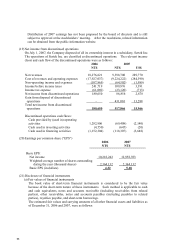

91

In 2006 and 2007, pension cost under the defined contribution retirement plans amounted to

NT$215,208 and NT$202,278, respectively.

(17) Income taxes

(a) Each consolidated entity should file its own separate income tax return.

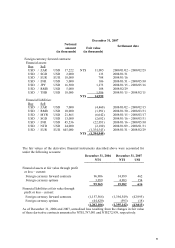

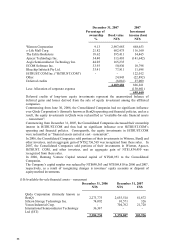

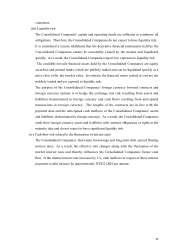

(b) The components of income tax expense from continuing operations for the years ended

December 31, 2006 and 2007, were as follows:

2006 2007

NT$ NT$ US$

Current income tax expense 2,654,232 2,726,875 84,072

Deferred income tax (benefit) expense 733,685 (61,297) (1,890)

3,387,917 2,665,578 82,182

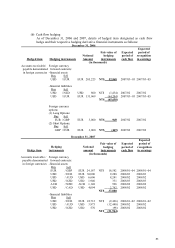

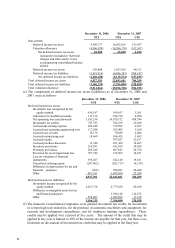

(c) The income tax calculated on the pre-tax income from continuing operations at the

Company’s statutory income tax rate (25%) was reconciled with the income tax expense of

continuing operations reported in the accompanying consolidated statements of income as

follows:

2006 2007

NT$ NT$ US$

Expected income tax expense 3,387,077 3,777,159 116,453

Effect of different tax rates applied to the

Company’s subsidiaries 1,631,667 1,786,743 55,087

Tax-exempt investment income from

domestic investees

(865,980) (592,587) (18,270)

Prior year adjustments (98,688) (53,756) (1,657)

Gain on disposal of marketable securities

not subject to income tax (1,438,910) (1,226,553) (37,816)

Investment tax credits 1,002,197 30,696 946

Change in valuation allowance (333,013) (699,088) (21,554)

Unutilized net operating loss carryforwards 375,500 - -

Tax-exempt investment income resulting

from operational headquarters (746,247) (1,132,967) (34,930)

Gain on disposal of land not subject to

income tax 78,750 (29,476) (909)

Alternative minimum tax 219,061 404,858 12,483

Others 176,503 400,549 12,349

Income tax expense 3,387,917 2,665,578 82,182

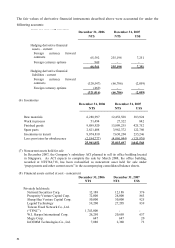

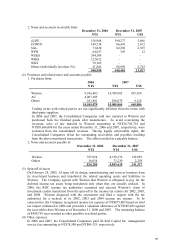

(d) The deferred income tax assets (liabilities) as of December 31, 2006 and 2007, were as

follows:

December 31, 2006 December 31, 2007

NT$ NT$ US$

Current:

Deferred income tax assets 1,977,846 4,624,566 142,579

Valuation allowance (1,005,132) (2,710,560) (83,568)

Net deferred income tax assets 972,714 1,914,006 59,011

Deferred income tax liabilities (included in

“accrued expenses and other current

liabilities” in the accompanying

consolidated balance sheets)

(566,319) (709,697) (21,881)