Acer 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Acer annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

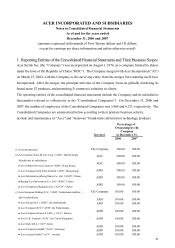

In preparation of the consolidated financial

statements, a remeasurement of the foreign

subsidiaries’ financial statements into the

functional currency is performed first, and the

remeasuring differences are accounted for as

exchange gains or losses in the accompanying

statements of income. Translation adjustments

resulting from the translation of foreign

currency nancial statements into the Company’

s reporting currency and a monetary item that

forms part of the Company’s net investment

in a foreign operation are accounted for as

translation adjustment, a separate component of

stockholders’ equity.

(d) Classification of current and noncurrent

assets and liabilities

Cash or cash equivalents, and assets that will be

held primarily for the purpose of being traded

or are expected to be realized within 12 months

after the balance sheet date are classified as

current assets; all other assets shall be classied

as non-current.

Liabilities that will be held primarily for the

purpose of being traded or are expected to be

settled within 12 months after the balance sheet

date are classied as current liabilities; all other

liabilities shall be classied as non-current.

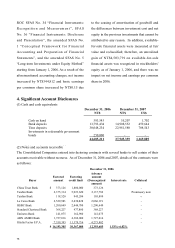

(e) Cash and cash equivalents

Cash and cash equivalents consist of cash on

hand, cash in banks, miscellaneous petty cash,

and other highly liquid investments which do

not have a significant level of market or credit

risk from potential interest rate changes.

(f) Allowance for doubtful accounts

Allowance for doubtful accounts is provided

based on the collectibility, aging and quality

analysis of notes and accounts receivable.

(g ) I nventories; land held f or sale and

development

Inventories are stated at the lower of cost or

market value. Costs of inventory are determined

using the weighted-average method. For channel

business, costs of inventory are determined

using the rst-in, rst-out method. Market value

represents net realizable value.

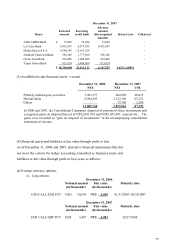

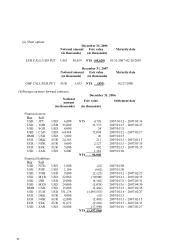

(h) Financial instruments

Th e Co nsoli da te d Com pa ni es a do pt ed

transaction date accounting for financial

ins tr um ent tr an sact ions. U pon in itial

recogni tio n, f ina ncia l instr umen ts ar e

evaluated at fair value. Except for trading-

purpose financial instruments, acquisition

cost or issuance cost is added to the originally

recognized amount. Subsequent to initial

recognition, financial instruments are classified

into the following categories in accordance

with the purpose of holding or issuing of such

nancial instruments :

(1)Financial assets/liabilities at fair value

through prot or loss

Derivatives that do not meet the criteria for

hedge accounting are classified as financial

assets or liabilities at fair value through prot