XM Radio 2013 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

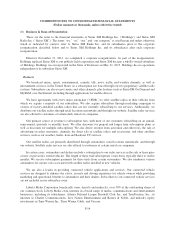

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

XM, which, except as noted, are essentially identical. Certain numbers in our prior period consolidated financial

statements have been reclassified to conform to our current period presentation. All significant intercompany

transactions and balances between Holdings and Sirius XM and their respective consolidated subsidiaries are

eliminated in both sets of consolidated financial statements. Intercompany transactions between Holdings and

Sirius XM do not eliminate in the Sirius XM consolidated financial statements, but do eliminate in the Holdings

consolidated financial statements.

The preparation of financial statements in conformity with GAAP requires management to make estimates

and assumptions that affect the amounts reported in the financial statements and footnotes. Estimates, by their

nature, are based on judgment and available information. Actual results could differ materially from those

estimates. Significant estimates inherent in the preparation of the accompanying consolidated financial

statements include asset impairment, depreciable lives of our satellites, share-based payment expense, and

valuation allowances against deferred tax assets.

(2) Acquisitions

On November 4, 2013, we purchased all of the outstanding shares of the capital stock of the connected

vehicle business of Agero, Inc. (“Agero”) for $525,352, net of acquired cash of $1,966. Agero’s connected

vehicle business provides services to several automakers, including Acura, BMW, Honda, Hyundai, Infiniti,

Lexus, Nissan and Toyota. The final working capital calculation associated with this transaction is still in

negotiation.

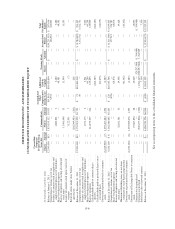

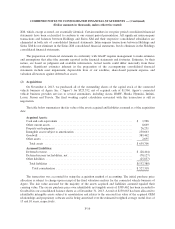

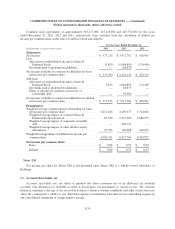

The table below summarizes the fair value of the assets acquired and liabilities assumed as of the acquisition

date:

Acquired Assets:

Cash and cash equivalents .................................................. $ 1,966

Other current assets ........................................................ 8,669

Property and equipment .................................................... 26,251

Intangible assets subject to amortization ....................................... 230,663

Goodwill ................................................................ 389,462

Other assets .............................................................. 2,695

Total assets ............................................................ $659,706

Assumed Liabilities:

Deferred revenue .......................................................... $ (28,404)

Deferred income tax liabilities, net ............................................ (78,127)

Other liabilities ........................................................... (25,857)

Total liabilities ......................................................... $(132,388)

Total consideration .................................................... $527,318

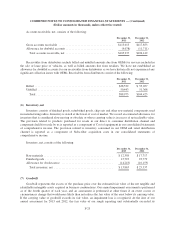

The transaction was accounted for using the acquisition method of accounting. The initial purchase price

allocation is subject to change upon receipt of the final valuation analysis for the connected vehicle business of

Agero. The fair value assessed for the majority of the assets acquired and liabilities assumed equaled their

carrying value. The excess purchase price over identifiable net tangible assets of $389,462 has been recorded to

Goodwill in our consolidated balance sheets as of December 31, 2013. A total of $230,663 has been allocated to

identifiable intangible assets subject to amortization and relates to the assessed fair value of the acquired OEM

relationships and proprietary software and is being amortized over the estimated weighted average useful lives of

15 and 10 years, respectively.

F-16