XM Radio 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

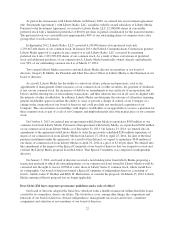

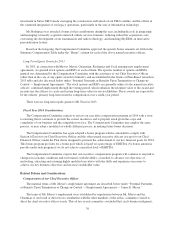

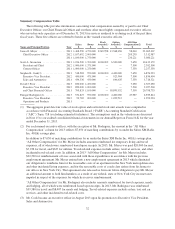

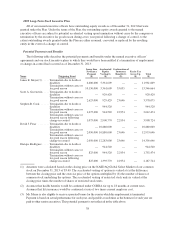

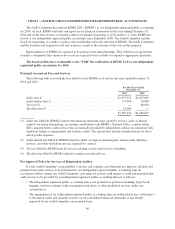

Summary Compensation Table

The following table provides information concerning total compensation earned by or paid to our Chief

Executive Officer, our Chief Financial Officer and our three other most highly compensated executive officers

who served in such capacities as of December 31, 2013 for services rendered to us during each of the past three

fiscal years. These five officers are referred to herein as the “named executive officers.”

Name and Principal Position Year

Salary

$

Bonus

$

Stock

Awards(1)

$

Option

Awards(1)

$

All Other

Compensation(2)

$

Total

$

James E. Meyer .................... 2013 1,468,590 4,720,000 3,249,998 13,568,656 58,063 23,065,307

Chief Executive Officer 2012 1,107,692 2,000,000 — — 205,295 3,312,987

2011 1,100,000 1,750,000 — — 236,221 3,086,221

Scott A. Greenstein ................. 2013 1,224,520 1,700,000 1,000,002 6,500,000 7,650 10,432,172

President and Chief

Content Officer

2012 1,000,000 1,375,000 — — 7,500 2,382,500

2011 1,000,000 1,250,000 — — 7,350 2,257,350

Stephen R. Cook(3) ................. 2013 518,583 950,000 1,000,000 4,400,000 7,650 6,876,233

Executive Vice President,

Sales and Automotive

2012 450,000 475,000 — 923,904 7,500 1,856,404

2011 434,536 430,000 — 846,635 7,350 1,718,521

David J. Frear ...................... 2013 850,000 1,450,000 — — 7,650 2,307,650

Executive Vice President

and Chief Financial Officer

2012 850,000 1,200,000 — — 7,500 2,057,500

2011 795,833 1,100,000 — 18,895,552 7,350 20,798,735

Enrique Rodriguez(4) ................ 2013 531,827 950,000 1,000,000 4,400,000 47,987 6,929,814

Executive Vice President,

Operations and Products

2012 93,782 200,000 — 1,099,512 — 1,393,294

2011 — — — — — —

(1) The aggregate grant date fair value of stock option and restricted stock unit awards were computed in

accordance with Financial Accounting Standards Board (“FASB”) Accounting Standard Codification

(“ASC”) Topic 718 (excluding estimated forfeitures). The assumptions used in the valuation are discussed

in Note 15 to our audited consolidated financial statements in our Annual Report on Form 10-K for the year

ended December 31, 2013.

(2) For each named executive officer, with the exception of Mr. Rodriguez, the amount in the “All Other

Compensation” column for 2013 reflects $7,650 of matching contributions by us under the Sirius XM Radio

Inc. 401(k) savings plan.

In addition to $7,650 of matching contributions by us under the Sirius XM Radio Inc. 401(k) savings plan,

“All Other Compensation” for Mr. Meyer includes amounts reimbursed for temporary living and travel

expenses, all of which were reimbursed based upon receipts. In 2013, Mr. Meyer was paid $20,000 for rent,

$7,256 for travel, and $637 for utilities. Travel-related expenses include airfare, taxi/car services, and other

incidental travel-related costs. In addition, in 2013 “All Other Compensation” for Mr. Meyer includes

$22,520 for reimbursement of taxes associated with these expenditures in accordance with his previous

employment agreement. Mr. Meyer entered into a new employment agreement in 2013 which eliminated

our obligation to reimburse him for the reasonable costs of an apartment in the New York metropolitan area

and other incidental living expenses, and for the reasonable costs of coach class airfare from his homes to

our offices in New York City. That agreement also released us from our future obligation to pay Mr. Meyer

an additional amount to hold him harmless as a result of any federal, state or New York City income taxes

imputed in respect of the expenses for which he receives reimbursement.

“All Other Compensation” for Mr. Rodriguez also includes amounts reimbursed for travel expenses, meals

and lodging, all of which were reimbursed based upon receipts. In 2013, Mr. Rodriguez was reimbursed

$39,580 for travel and $8,407 for meals and lodging. Travel-related expenses include airfare, taxi and car

services, and other incidental travel-related costs.

(3) Mr. Cook became an executive officer in August 2013 upon his promotion to Executive Vice President,

Sales and Automotive.

32