XM Radio 2013 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

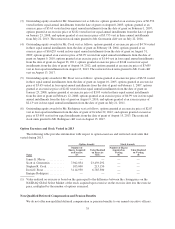

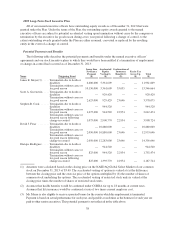

2009 Long-Term Stock Incentive Plan

All of our named executive officers have outstanding equity awards as of December 31, 2013 that were

granted under the Plan. Under the terms of the Plan, the outstanding equity awards granted to the named

executive officers are subject to potential accelerated vesting upon termination without cause by the company or

termination by the executive for good reason during a two year period following a change of control, to the

extent outstanding awards granted under the Plan are either assumed, converted or replaced by the resulting

entity in the event of a change of control.

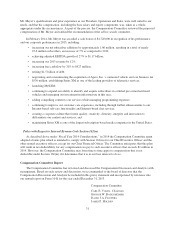

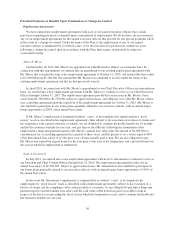

Potential Payments and Benefits

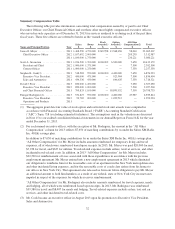

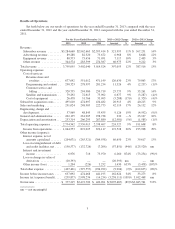

The following table describes the potential payments and benefits under the named executive officers’

agreements and our stock incentive plans to which they would have been entitled if a termination of employment

or change-in-control had occurred as of December 31, 2013:

Name Triggering Event

Lump Sum

Severance

Payment

($)

Accelerated

Equity

Vesting(1)

($)

Continuation of

Insurance

Benefits(2)

($)

Excise Tax

Gross-Up

($)

Total

($)

James E. Meyer(3) .....Termination due to death or

disability 6,600,000 5,361,609 — — 11,961,609

Termination without cause or

for good reason 10,150,000 5,361,609 35,055 — 15,546,664

Scott A. Greenstein ....Termination due to death or

disability — 929,429 — — 929,429

Termination without cause or

for good reason 2,625,000 929,429 23,646 — 3,578,075

Stephen R. Cook ......Termination due to death or

disability — 944,520 — — 944,520

Termination without cause or

for good reason 1,075,000 944,520 22,954 — 2,042,474

Termination without cause or

for good reason following

change-in-control 1,075,000 2,900,770 22,954 — 3,998,724

David J. Frear ........Termination due to death or

disability — 10,880,000 — — 10,880,000

Termination without cause or

for good reason 2,050,000 10,880,000 23,646 — 12,953,646

Termination without cause or

for good reason following

change-in-control 2,050,000 12,283,000 23,646 — 14,356,646

Enrique Rodriguez .....Termination due to death or

disability — 944,520 — — 944,520

Termination without cause or

for good reason 825,000 944,520 22,954 — 1,792,474

Termination without cause or

for good reason following

change-in-control 825,000 1,339,770 22,954 — 2,187,724

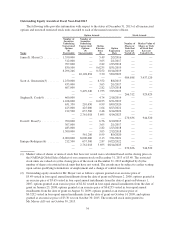

(1) Amounts were calculated based on the closing price on the NASDAQ Global Select Market of our common

stock on December 31, 2013 of $3.49. The accelerated vesting of options is valued at (a) the difference

between the closing price and the exercise price of the options multiplied by (b) the number of shares of

common stock underlying the options. The accelerated vesting of restricted stock units is valued at the

closing price times the number of shares of restricted stock units.

(2) Assumes that health benefits would be continued under COBRA for up to 18 months at current rates.

Assumes that life insurance would be continued at rate of two times current employer cost.

(3) Mr. Meyer is also eligible to receive a prorated bonus for the year in which his employment is terminated.

Payment is based on actual performance for such year, and payable at such time as the bonuses for such year are

paid to other senior executives. This potential payment is not reflected in the table above.

38