XM Radio 2013 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

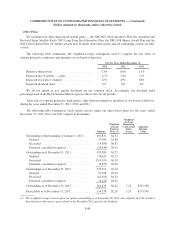

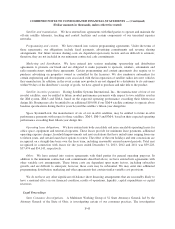

Common Stock, Sirius XM, par value $0.001 per share

Due to our corporate reorganization in November 2013, 1,000 shares of common stock were authorized,

issued and outstanding, and are owned by Holdings as of December 31, 2013.

Preferred Stock, Holdings, par value $0.001 per share

We were authorized to issue up to 50,000,000 shares of undesignated preferred stock as of December 31,

2013 and 2012, respectively.

There were 6,250,100 shares of Series B Preferred Stock issued and outstanding as of December 31, 2012

held by Liberty Media. In January 2013, Liberty Media converted its remaining shares of the Series B Preferred

Stock into 1,293,509,076 shares of our common stock.

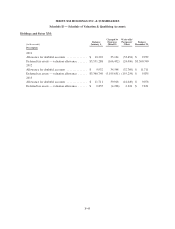

Warrants

We have issued warrants to purchase shares of our common stock in connection with distribution,

programming and satellite purchase agreements. As of December 31, 2013 and 2012, approximately 18,455,000

warrants to acquire an equal number of shares of common stock were outstanding and fully vested. Warrants

were included in our calculation of diluted net income per common share as the effect was dilutive for the year

ended December 31, 2013. The warrants expire at various times through 2015. At December 31, 2013 and 2012,

the weighted average exercise price of outstanding warrants was $2.55 per share. We did not incur warrant

related expenses during the years ended December 31, 2013, 2012 or 2011.

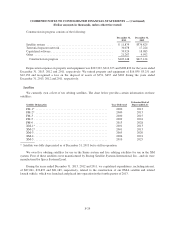

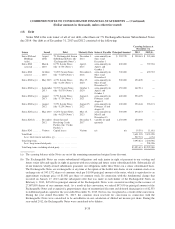

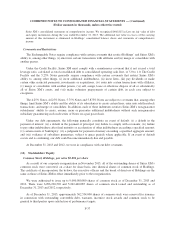

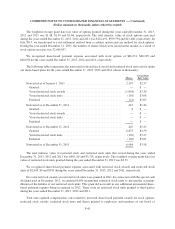

(warrants in thousands)

Average

Exercise

Price

Expiration

Date

Number of

Warrants

Outstanding

December 31,

2013 2012

NFL .......................................... $2.50 March 2015 16,667 16,667

Other distributors and programming providers ......... $3.00 June 2014 1,788 1,788

Total ....................................... 18,455 18,455

In October 2012, 4,000,000 warrants held by a distributor expired.

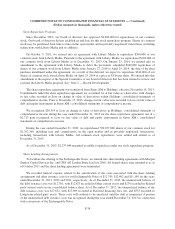

(15) Benefit Plans

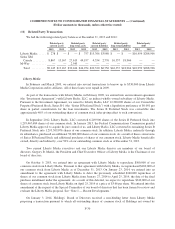

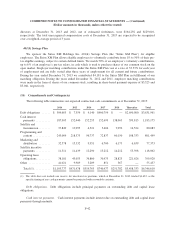

We recognized share-based payment expense of $68,876, $63,822 and $51,622 for the years ended

December 31, 2013, 2012 and 2011, respectively.

2009 Long-Term Stock Incentive Plan

In May 2009, our stockholders approved the Sirius XM Radio Inc. 2009 Long-Term Stock Incentive Plan

(the “2009 Plan”). Employees, consultants and members of our board of directors are eligible to receive awards

under the 2009 Plan. The 2009 Plan provides for the grant of stock options, restricted stock awards, restricted

stock units and other stock-based awards that the compensation committee of our board of directors may deem

appropriate. Vesting and other terms of stock-based awards are set forth in the agreements with the individuals

receiving the awards. Stock-based awards granted under the 2009 Plan are generally subject to a vesting

requirement. Stock-based awards generally expire ten years from the date of grant. Each restricted stock unit

entitles the holder to receive one share of common stock upon vesting. As of December 31, 2013, approximately

82,806,000 shares of common stock were available for future grants under the 2009 Plan.

F-39