XM Radio 2013 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

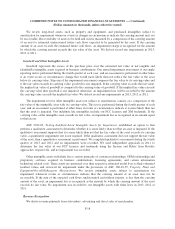

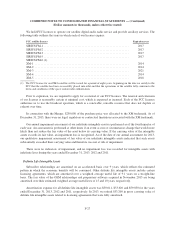

Revenue from subscribers consists of subscription fees, daily rental fleet revenue and non-refundable

activation and other fees. Revenue is recognized as it is realized or realizable and earned. We recognize

subscription fees as our services are provided. At the time of sale, vehicle owners purchasing or leasing a vehicle

with a subscription to our service typically receive between a three and twelve month prepaid subscription.

Prepaid subscription fees received from certain automakers are recorded as deferred revenue and amortized to

revenue ratably over the service period which commences upon retail sale and activation.

We recognize revenue from the sale of advertising as the advertising is broadcast. Agency fees are

calculated based on a stated percentage applied to gross billing revenue for our advertising inventory and are

reported as a reduction of advertising revenue. We pay certain third parties a percentage of advertising revenue.

Advertising revenue is recorded gross of such revenue share payments as we are the primary obligor in the

transaction. Advertising revenue share payments are recorded to Revenue share and royalties during the period in

which the advertising is broadcast.

Equipment revenue and royalties from the sale of satellite radios, components and accessories are

recognized upon shipment, net of discounts and rebates. Shipping and handling costs billed to customers are

recorded as revenue. Shipping and handling costs associated with shipping goods to customers are reported as a

component of Cost of equipment.

ASC 605, Revenue Recognition, provides guidance on how and when to recognize revenues for

arrangements that may involve the delivery or performance of multiple products, services and/or rights to use

assets, such as in our bundled subscription plans. Revenue arrangements with multiple deliverables are required

to be divided into separate units of accounting if the deliverables in the arrangement meet certain criteria.

Consideration must be allocated at the inception of the arrangement to all deliverables based on their relative

selling price, which has been determined using vendor specific objective evidence of the selling price to self-pay

customers.

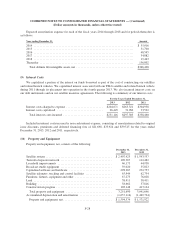

Revenue Share

We share a portion of our subscription revenues earned from subscribers with certain automakers. The terms

of the revenue share agreements vary with each automaker, but are typically based upon the earned audio

revenue as reported or gross billed audio revenue. Revenue share is recorded as an expense in our consolidated

statements of comprehensive income and not as a reduction to revenue.

Programming Costs

Programming costs which are for a specified number of events are amortized on an event-by-event basis;

programming costs which are for a specified season or period are amortized over the season or period on a

straight-line basis. We allocate a portion of certain programming costs which are related to sponsorship and

marketing activities to Sales and marketing expense on a straight-line basis over the term of the agreement.

Advertising Costs

Media is expensed when aired and advertising production costs are expensed as incurred. Market

development funds consist of fixed and variable payments to reimburse retailers for the cost of advertising and

other product awareness activities. Fixed market development funds are expensed over the periods specified in

the applicable agreement; variable costs are expensed when the media is aired and production costs are expensed

as incurred. During the years ended December 31, 2013, 2012 and 2011, we recorded advertising costs of

$178,364, $139,830 and $116,694, respectively. These costs are reflected in Sales and marketing expense in our

consolidated statements of comprehensive income.

F-19