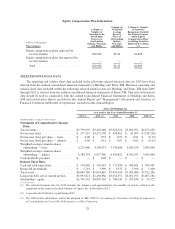

XM Radio 2013 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

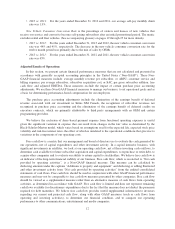

Certain of our in-orbit satellites have experienced circuit failures on their solar arrays. We continue to

monitor the operating condition of our in-orbit satellites. If events or circumstances indicate that the depreciable

lives of our in-orbit satellites have changed, we will modify the depreciable life accordingly. If we were to revise

our estimates, our depreciation expense would change. For example, a 10% decrease in the expected depreciable

lives of satellites and spacecraft control facilities during 2013 would have resulted in approximately $24,395 of

additional depreciation expense.

Income Taxes. Deferred income taxes are recognized for the tax consequences related to temporary

differences between the carrying amount of assets and liabilities for financial reporting purposes and the amounts

used for tax purposes, based on enacted tax laws and statutory tax rates applicable to the periods in which the

differences are expected to affect taxable income. In determining the period in which related tax benefits are

realized for book purposes, excess share-based compensation deductions included in net operating losses are

realized after regular net operating losses are exhausted; excess tax compensation benefits are recorded off-

balance sheet as a memo entry until the period the excess tax benefit is realized through a reduction of taxes

payable. A valuation allowance is recognized when, based on the weight of all available evidence, it is

considered more likely than not that all, or some portion, of the deferred tax assets will not be realized. Income

tax expense is the sum of current income tax plus the change in deferred tax assets and liabilities.

As of December 31, 2013, we had a valuation allowance of $7,831 relating to deferred tax assets that are not

likely to be realized due to certain state net operating loss limitations.

Glossary

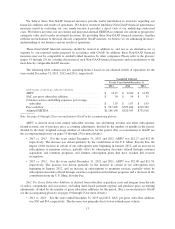

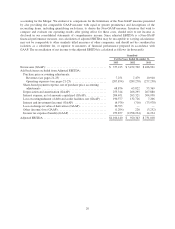

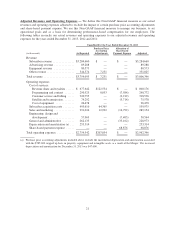

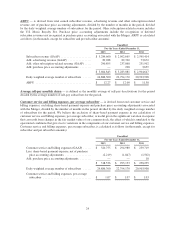

Adjusted EBITDA — EBITDA is defined as net income before interest and investment income (loss); interest

expense, net of amounts capitalized; income tax expense and depreciation and amortization. We adjust EBITDA

to remove the impact of other income and expense, loss on extinguishment of debt, loss on change in value of

derivatives as well as certain other charges discussed below. This measure is one of the primary Non-GAAP

financial measures on which we (i) evaluate the performance of our businesses, (ii) base our internal budgets and

(iii) compensate management. Adjusted EBITDA is a Non-GAAP financial performance measure that excludes

(if applicable): (i) certain adjustments as a result of the purchase price accounting for the Merger,

(ii) depreciation and amortization and (iii) share-based payment expense. The purchase price accounting

adjustments include: (i) the elimination of deferred revenue associated with the investment in XM Canada,

(ii) recognition of deferred subscriber revenues not recognized in purchase price accounting, and (iii) elimination

of the benefit of deferred credits on executory contracts, which are primarily attributable to third party

arrangements with an OEM and programming providers. We believe adjusted EBITDA is a useful measure of the

underlying trend of our operating performance, which provides useful information about our business apart from

the costs associated with our physical plant, capital structure and purchase price accounting. We believe investors

find this Non-GAAP financial measure useful when analyzing our results and comparing our operating

performance to the performance of other communications, entertainment and media companies. We believe

investors use current and projected adjusted EBITDA to estimate our current and prospective enterprise value

and to make investment decisions. Because we fund and build-out our satellite radio system through the periodic

raising and expenditure of large amounts of capital, our results of operations reflect significant charges for

depreciation expense. The exclusion of depreciation and amortization expense is useful given significant

variation in depreciation and amortization expense that can result from the potential variations in estimated

useful lives, all of which can vary widely across different industries or among companies within the same

industry. We also believe the exclusion of share-based payment expense is useful given the significant variation

in expense that can result from changes in the fair value as determined using the Black-Scholes-Merton model

which varies based on assumptions used for the expected life, expected stock price volatility and risk-free interest

rates.

Adjusted EBITDA has certain limitations in that it does not take into account the impact to our statements of

comprehensive income of certain expenses, including share-based payment expense and certain purchase price

19