XM Radio 2013 Annual Report Download - page 97

Download and view the complete annual report

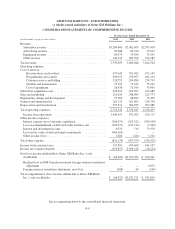

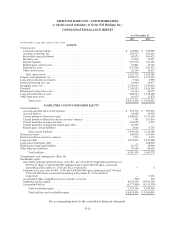

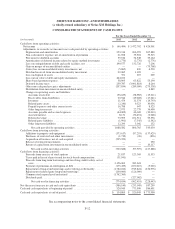

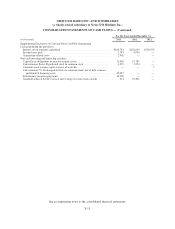

Please find page 97 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

Recent Development

On January 3, 2014, Holdings’ Board of Directors received a non-binding letter from Liberty Media

proposing a transaction pursuant to which all outstanding shares of common stock of Holdings not owned by

Liberty Media would be converted into the right to receive 0.0760 of a new share of Liberty Series C common

stock, which would have no voting rights. Liberty Media indicated that immediately prior to such conversion,

Liberty Media intends to distribute, on a 2 to 1 basis, shares of such Series C common stock to all holders of

record of Liberty Media’s Series A and B common stock. Upon the completion of the proposed transaction,

Liberty Media indicated that it expects that Holdings’ public stockholders would own approximately 39% of

Liberty Media’s then-outstanding common stock.

Holdings’ Board of Directors has formed a Special Committee of independent directors to consider Liberty

Media’s proposal. The Board of Directors has selected Joan L. Amble, James P. Holden and Eddy W.

Hartenstein to serve on the Special Committee. The Special Committee is chaired by Mr. Hartenstein.

The Special Committee has retained Evercore Group L.L.C. to act as its financial advisor and Weil,

Gotshal & Manges LLP to act as its legal counsel to assist and advise it in connection with its evaluation of

Liberty Media’s proposal.

Liberty Media’s proposal noted that the transaction will be conditioned on the approval of both the Special

Committee and a majority of the public stockholders of Holdings, other than Liberty Media. Liberty Media also

noted that the approval by the Liberty Media stockholders of the issuance of the Series C common shares in the

proposed transaction would also be required under applicable Nasdaq Stock Market requirements.

The letter provides that no legally binding obligation with respect to any transaction exists unless and until

mutually acceptable definitive documentation is executed and delivered with respect thereto. There can be no

assurance that the transaction proposed by Liberty Media or any related transaction will be completed or, if

completed, will have any specified terms, including with respect to pricing or timing.

Basis of Presentation

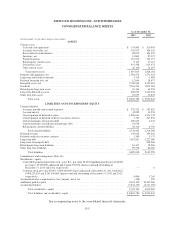

Our financial statements include the consolidated accounts for Holdings and subsidiaries and the

accompanying consolidated financial statements of Sirius XM and subsidiaries, whose operating results and

financial position are consolidated into Holdings. The consolidated balance sheets and statements of

comprehensive income for Holdings are essentially identical to the consolidated balance sheets and consolidated

statements of comprehensive income for Sirius XM, with the following exceptions:

• Besides the shares which settled in November, the fair value of the share repurchase agreement with

Liberty Media is recorded in Holdings’ consolidated balance sheet, with changes in fair value recorded in

Holdings’ statements of comprehensive income.

• The additional fair value in excess of the carrying amount associated with the conversion feature for the

7% Exchangeable Senior Subordinated Notes due 2014 is recorded in Sirius XM’s consolidated balance

sheet, with changes in fair value recorded in Sirius XM’s statements of comprehensive income. This is

eliminated in Holdings’ consolidated balance sheets and statements of comprehensive income.

• As a result of our corporate reorganization effective November 15, 2013, all of the outstanding shares of

Sirius XM’s common stock were converted, on a share for share basis, into identical shares of common

stock of Holdings.

Our financial statements have been prepared in accordance with U.S. generally accepted accounting

principles (“GAAP”). The combined notes to the consolidated financial statements relate to Holdings and Sirius

F-15