XM Radio 2013 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

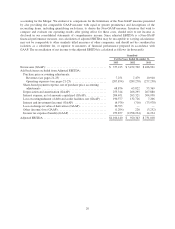

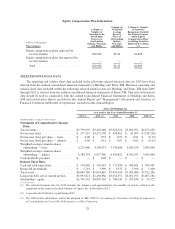

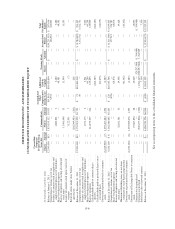

Supplementary discussion for Sirius XM:

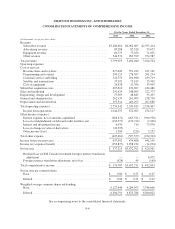

The consolidated statements of comprehensive income of Sirius XM are essentially identical to the

consolidated statements of comprehensive income of Holdings, except for the following:

For the Years Ended December 31,

2013 2012 2011

Net income attributable to Holdings .................... $377,215 $3,472,702 $426,961

Loss on change in value of derivative for forward contract

with Liberty Media included in Holdings’ consolidated

statements of comprehensive income (a) ............... 23,106 — —

Loss on change in fair value of 7% Exchangeable Senior

Subordinated Notes due 2014 included in Sirius XM’s

consolidated statements of comprehensive income (b) .... (466,815) — —

Net income attributable to Sirius XM’s sole stockholder .... $ (66,494) $3,472,702 $426,961

(a) The fair value of the Share Repurchase Agreement with Liberty Media is recorded in Holdings’ consolidated balance

sheet, with changes in fair value recorded in Holdings’ statements of comprehensive income. The impact of the Share

Repurchase Agreement is excluded from Sirius XM’s financial statements as the publicly traded common stock being

repurchased by Liberty Media resides at Holdings, effective November 15, 2013.

(b) The additional fair value in excess of the carrying amount associated with the 7% Exchangeable Senior Subordinated

Notes due 2014 is recorded in Sirius XM’s consolidated balance sheet, with changes in fair value recorded in Sirius

XM’s statements of comprehensive income. This is eliminated in Holdings’ consolidated balance sheets and statements

of comprehensive income.

For a discussion and analysis of Sirius XM’s financial condition and results, refer to “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” included in this Section.

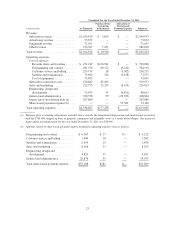

ISSUER PURCHASES OF EQUITY SERVICES

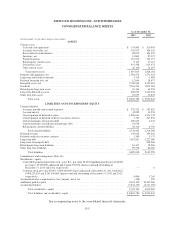

The following table provides information about our purchases of equity securities registered pursuant to

Section 12 of the Securities Exchange Act of 1934, as amended, during the quarter ended December 31, 2013:

Period

Total

Number of

Shares Purchased

Average

Price Paid

Per Share (1)

Total Number of

Shares Purchased

as Part of Publicly

Announced Plans

or Programs

Approximate

Dollar Value of

Shares that May

Yet Be Purchased

Under the Plans

or Programs (1)

October 1, 2013 — October 31,

2013 .......................... — $ — — $2,397,639,899

November 1, 2013 — November 30,

2013 .......................... 43,712,265 $3.66 43,712,265 $2,237,639,895

December 1, 2013 — December 31,

2013 .......................... — $ — — $2,237,639,895

Total ......................... 43,712,265 $3.66 43,712,265 $2,237,639,895

(1) These amounts include fees and commissions associated with the shares repurchased.

26