XM Radio 2013 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

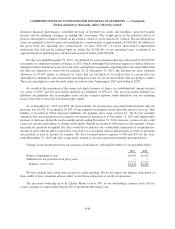

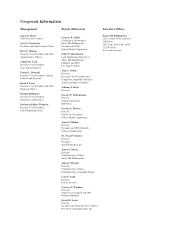

Sirius XM

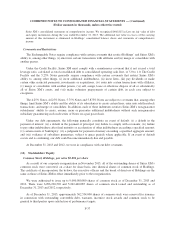

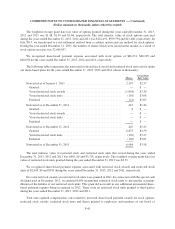

Sirius XM and its wholly-owned subsidiaries are included in the consolidated federal income tax returns of

Holdings. However, due to the differences in the Income before income taxes balances between Holdings and

Sirius XM in our consolidated statements of comprehensive income, the following table shows the significant

elements contributing to the difference between the federal tax expense (benefit) at the statutory rate and at Sirius

XM’s effective rate:

For the Years Ended December 31,

2013 2012 2011

Federal tax expense, at statutory rate ................... $ 67,684 $ 166,064 $ 154,418

State income tax expense, net of federal benefit .......... 4,467 16,606 15,751

State income rate changes ........................... 8,666 2,251 3,851

Non-deductible expenses ............................ 699 477 457

Change in valuation allowance ........................ (4,228) (3,195,651) (166,452)

Fair value of debt instrument ......................... 178,704 — —

Other, net ........................................ 3,885 12,019 6,209

Income tax expense (benefit) ....................... $259,877 $(2,998,234) $ 14,234

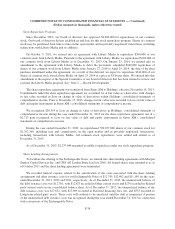

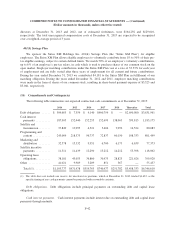

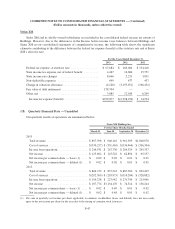

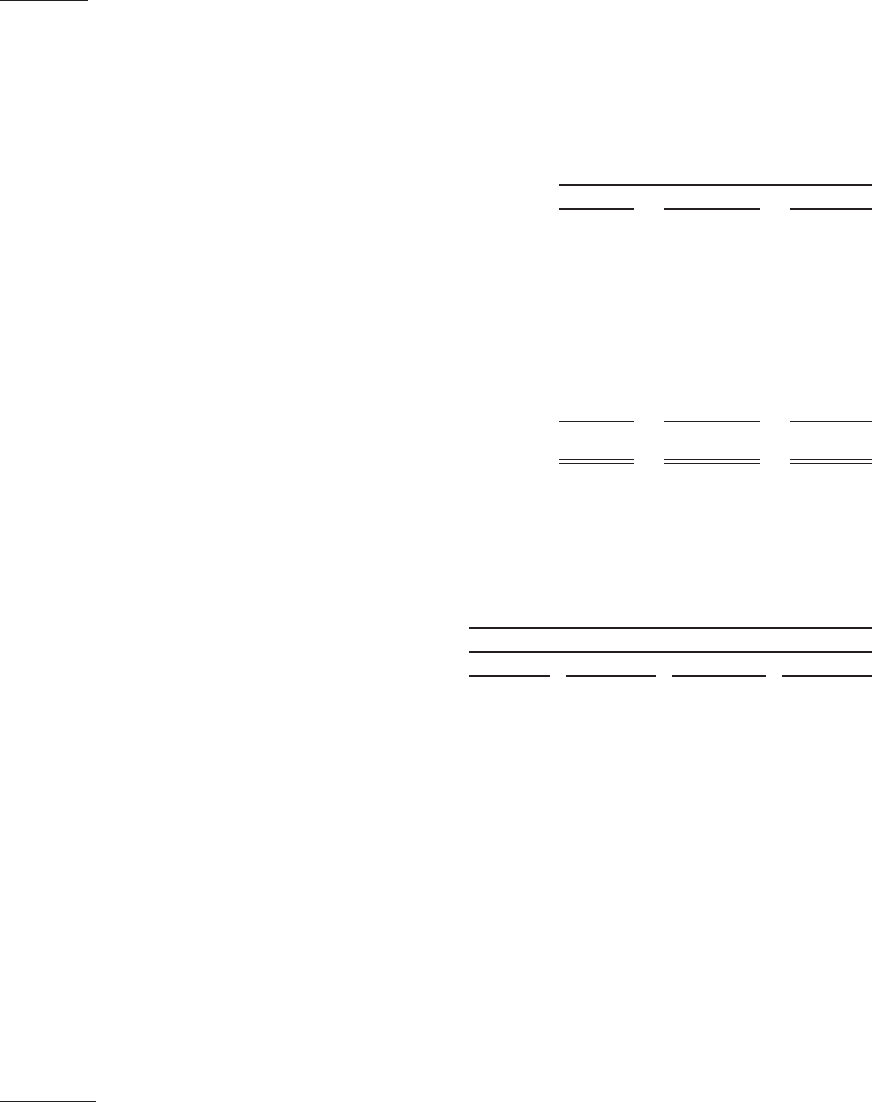

(18) Quarterly Financial Data — Unaudited

Our quarterly results of operations are summarized below:

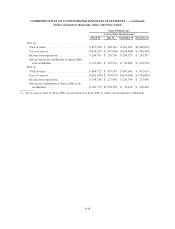

Sirius XM Holdings Inc.

For the Three Months Ended

March 31 June 30 September 30 December 31

2013

Total revenue ............................ $897,398 $ 940,110 $ 961,509 $1,000,078

Cost of services .......................... $(330,257) $ (331,465) $(336,464) $ (396,304)

Income from operations .................... $246,931 $ 267,736 $ 284,529 $ 245,357

Net income ............................. $123,602 $ 125,522 $ 62,894 $ 65,197

Net income per common share — basic (1) .... $ 0.02 $ 0.02 $ 0.01 $ 0.01

Net income per common share — diluted (1) . . . $ 0.02 $ 0.02 $ 0.01 $ 0.01

2012

Total revenue ............................ $804,722 $ 837,543 $ 867,360 $ 892,415

Cost of services .......................... $(292,309) $ (293,975) $(314,204) $ (328,882)

Income from operations .................... $199,238 $ 227,942 $ 231,749 $ 213,096

Net income ............................. $107,774 $3,134,170 $ 74,514 $ 156,244

Net income per common share — basic (1) .... $ 0.02 $ 0.49 $ 0.01 $ 0.02

Net income per common share — diluted (1) . . . $ 0.02 $ 0.48 $ 0.01 $ 0.02

(1) The sum of quarterly net income per share applicable to common stockholders (basic and diluted) does not necessarily

agree to the net income per share for the year due to the timing of common stock issuances.

F-47