XM Radio 2013 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

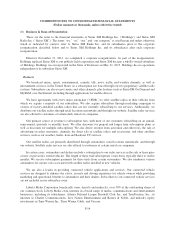

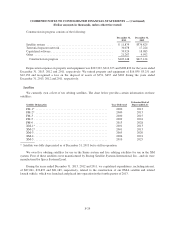

ii. Level 2 input — observable market data for the same or similar instrument but not Level 1, including

quoted prices for identical or similar assets or liabilities in markets that are active or not active or other

inputs that are observable or can be corroborated by observable market data for substantially the full

term of the assets or liabilities; and

iii. Level 3 input — unobservable inputs developed using management’s assumptions about the inputs

used for pricing the asset or liability.

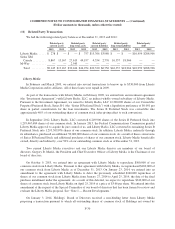

Level 2 inputs were utilized to fair value our 7% Exchangeable Senior Subordinated Notes due 2014 by

using a binomial lattice model with inputs derived from observable market data. As of December 31, 2013,

$466,815 was recorded to Sirius XM’s consolidated balance sheet in Current maturities of long-term debt for the

fair value of our 7% Exchangeable Senior Subordinated Notes due 2014 in excess of the carrying amount, as the

notes are exchangeable into shares of Holdings’ common stock. Changes in fair value are recorded in Loss on

fair value of debt and equity instruments within Sirius XM’s consolidated statements of comprehensive income.

We recognized $466,815 in Loss on fair value of debt and equity instruments during the year ended

December 31, 2013. The additional fair value in excess of the carrying amount of this instrument is eliminated in

Holdings’ consolidated balance sheets and statements of comprehensive income.

We used Level 2 observable inputs, including the U.S. spot LIBOR curve and other available market data, to fair

value the derivative associated with the share repurchase agreement with Liberty Media. The fair value of the derivative

associated with the share repurchase agreement with Liberty Media was $15,702 as of December 31, 2013 and is

recorded in Holdings’ consolidated balance sheet in Related party current liabilities, with changes in fair value recorded

to Holdings’ statements of comprehensive income. For a further discussion of this derivative, refer to Note 14.

We used Level 3 inputs to fair value the 8% convertible unsecured subordinated debentures issued by Sirius

XM Canada. For a further discussion of this derivative, refer to Note 11.

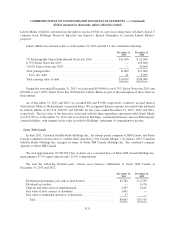

Investments are periodically reviewed for impairment and an impairment is recorded whenever declines in

fair value below carrying value are determined to be other than temporary. In making this determination, we

consider, among other factors, the severity and duration of the decline as well as the likelihood of a recovery

within a reasonable timeframe.

The fair value for publicly traded instruments is determined using quoted market prices while the fair value

for non-publicly traded instruments is based upon estimates from a market maker and brokerage firm. As of

December 31, 2013 and 2012, the carrying value of our debt at Holdings’ was $3,601,595 and $2,435,220,

respectively, and the fair value approximated $4,066,755 and $3,055,076, respectively. This excludes the

additional fair value of our 7% Exchangeable Senior Subordinated Notes due 2014 recorded in Sirius XM’s

consolidated balance sheet as discussed above. The carrying value of our investment in Sirius XM Canada was

$26,972 and $37,983 as of December 31, 2013 and 2012, respectively; the fair value approximated $432,200 and

$290,900 as of December 31, 2013 and 2012, respectively.

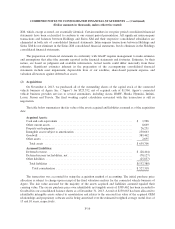

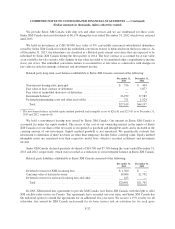

Accumulated Other Comprehensive Income (Loss)

Accumulated other comprehensive loss of $308 at December 31, 2013 was primarily comprised of the

cumulative foreign currency translation adjustments related to our interest in Sirius XM Canada. During the years

ended December 31, 2013, 2012 and 2011 we recorded a foreign currency translation adjustment of $(428), $49

and $(140) which is recorded net of taxes of $200, $48 and $11, respectively. In addition, during the year ended

December 31, 2011, we recorded a loss on our XM Canada investment from the Canada Merger due to a foreign

currency translation adjustment of $6,072.

F-22