XM Radio 2013 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

Stock Repurchase Program

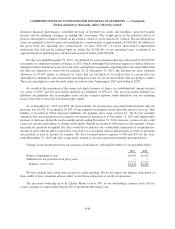

Since December 2012, our board of directors has approved $4,000,000 for repurchases of our common

stock. Our board of directors did not establish an end date for this stock repurchase program. Shares of common

stock may be purchased from time to time on the open market and in privately negotiated transactions, including

transactions with Liberty Media and its affiliates.

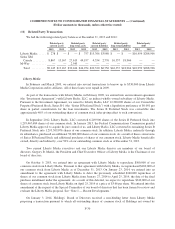

On October 9, 2013, we entered into an agreement with Liberty Media to repurchase $500,000 of our

common stock from Liberty Media. Pursuant to the agreement with Liberty Media, we repurchased $160,000 of

our common stock from Liberty Media as of December 31, 2013. On January 23, 2014, we entered into an

amendment to the agreement with Liberty Media to defer the previously scheduled $240,000 repurchase of

shares of our common stock from Liberty Media from January 27, 2014 to April 25, 2014, the date of the final

purchase installment under the agreement. As a result of this deferral, we expect to repurchase $340,000 of our

shares of common stock from Liberty Media on April 25, 2014 at a price of $3.66 per share. We entered into this

amendment at the request of the Special Committee of our board of directors that has been formed to review and

evaluate the Liberty Media proposal. See “Note 1 — Recent Developments.”

The share repurchase agreement was transferred from Sirius XM to Holdings’ effective November 15, 2013.

Commitments under the share repurchase agreement are accounted for at fair value as a derivative, with changes

in fair value recorded in Loss on change in value of derivatives within Holdings’ consolidated statements of

comprehensive income. Prior to November 15, 2013, changes in fair value were recorded to Loss on fair value of

debt and equity instruments in Sirius XM’s consolidated statements of comprehensive income.

We recognized $20,393 to Loss on change in value of derivatives in Holdings’ consolidated statement of

comprehensive income during the year ended December 31, 2013 for the share repurchase agreement, net of a

$2,713 gain recognized to Loss on fair value of debt and equity instruments in Sirius XM’s consolidated

statements of comprehensive income.

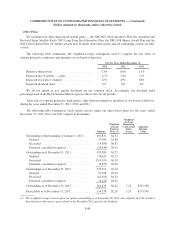

During the year ended December 31, 2013, we repurchased 520,257,866 shares of our common stock for

$1,762,360, including fees and commissions, on the open market and in privately negotiated transactions,

including transactions with Liberty Media. All common stock repurchases were settled and retired as of

December 31, 2013.

As of December 31, 2013, $2,237,640 remained available for purchase under our stock repurchase program.

Share Lending Arrangements

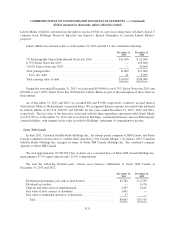

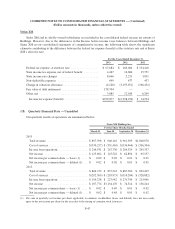

To facilitate the offering of the Exchangeable Notes, we entered into share lending agreements with Morgan

Stanley Capital Services Inc. and UBS AG London Branch in July 2008. All loaned shares were returned to us as

of October 2011 and the share lending agreements were terminated.

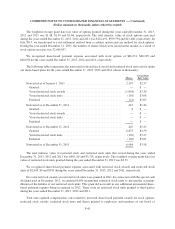

We recorded interest expense related to the amortization of the costs associated with the share lending

arrangement and other issuance costs for our Exchangeable Notes of $12,745, $12,402 and $11,189 for the years

ended December 31, 2013, 2012 and 2011, respectively. As of December 31, 2013, the unamortized balance of

the debt issuance costs was $12,701, with $12,423 recorded in Other current assets and $278 recorded in Related

party current assets in our consolidated balance sheet. As of December 31, 2012, the unamortized balance of the

debt issuance costs was $27,652, with $27,099 recorded in Deferred financing fees, net, and $553 recorded in

Long-term related party assets. These costs will continue to be amortized until the debt is terminated. A portion

of the unamortized debt issuance costs was recognized during the year ended December 31, 2013 in connection

with conversions of the Exchangeable Notes.

F-38