XM Radio 2013 Annual Report Download - page 69

Download and view the complete annual report

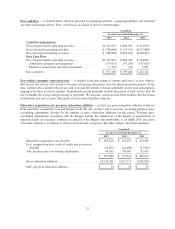

Please find page 69 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.On October 9, 2013, we entered into an agreement with Liberty Media to repurchase $500 million of our

common stock from Liberty Media. Pursuant to the agreement with Liberty Media, we repurchased $160 million

of our common stock from Liberty Media as of December 31, 2013. On January 23, 2014, we entered into an

amendment to the agreement with Liberty Media to defer the previously scheduled $240 million repurchase of

shares of our common stock from Liberty Media from January 27, 2014 to April 25, 2014, the date of the final

purchase installment under the agreement. As a result of this deferral, we expect to repurchase $340 million of

our shares of common stock from Liberty Media on April 25, 2014 at a price of $3.66 per share. We entered into

this amendment at the request of the Special Committee of our board of directors formed to review and evaluate

the Liberty Media proposal.

During the year ended December 31, 2013, we repurchased 520,257,866 shares of our common stock for

$1,762,360, including fees and commissions, on the open market and in privately negotiated transactions,

including transactions with Liberty Media. All common stock repurchases were settled and retired as of

December 31, 2013. As of December 31, 2013, $2,237,640 remained available under our stock repurchase

program. We expect to fund future repurchases through a combination of cash on hand, cash generated by

operations and future borrowings.

Debt Covenants

Our indentures and the agreement governing our Credit Facility include restrictive covenants. As of

December 31, 2013, we were in compliance with the indentures and the agreement governing our Credit Facility.

For a discussion of our “Debt Covenants,” refer to Note 13 to our consolidated financial statements in this

Annual Report.

Off-Balance Sheet Arrangements

We do not have any significant off-balance sheet arrangements other than those disclosed in Note 16 to our

consolidated financial statements in this Annual Report that are reasonably likely to have a material effect on our

financial condition, results of operations, liquidity, capital expenditures or capital resources.

Contractual Cash Commitments

For a discussion of our “Contractual Cash Commitments,” refer to Note 16 to our consolidated financial

statements in this Annual Report.

Related Party Transactions

For a discussion of “Related Party Transactions,” refer to Note 11 to our consolidated financial statements

in this Annual Report.

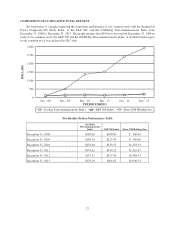

Critical Accounting Policies and Estimates

Our consolidated financial statements are prepared in accordance with GAAP, which requires management

to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and expenses during the periods. Accounting estimates

require the use of significant management assumptions and judgments as to future events, and the effect of those

events cannot be predicted with certainty. The accounting estimates will change as new events occur, more

experience is acquired and more information is obtained. We evaluate and update our assumptions and estimates

on an ongoing basis and use outside experts to assist in that evaluation when we deem necessary. We have

disclosed all significant accounting policies in Note 3 to our consolidated financial statements in this Annual

Report.

17