XM Radio 2013 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

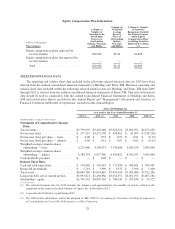

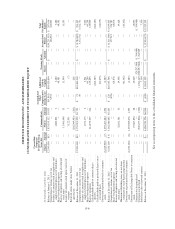

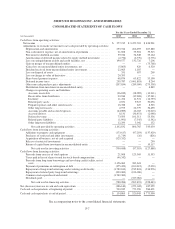

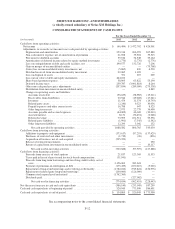

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF STOCKHOLDERS’ EQUITY

Convertible

Perpetual

Preferred Stock,

Series B-1 Common Stock

Accumulated

Other

Comprehensive

Income (Loss)

Additional

Paid-in

Capital

Treasury Stock Accumulated

Deficit

Total

Stockholders’

Equity(in thousands, except share data) Shares Amount Shares Amount Shares Amount

Balance at January 1, 2011 ................ 12,500,000 $13 3,933,195,112 $3,933 $(5,861) $10,420,604 — $ — $(10,211,053) $ 207,636

Comprehensive income, net of tax ........... — — — — 5,932 — — — 426,961 432,893

Issuance of common stock to employees and

employee benefit plans, net of forfeitures . . . — — 1,882,801 2 — 3,480 — — — 3,482

Share-based payment expense .............. — — — — — 48,581 — — — 48,581

Exercise of options and vesting of restricted

stock units ........................... — — 13,401,048 13 — 11,540 — — — 11,553

Issuance of common stock upon exercise of

warrants ............................. — — 7,122,951 7 — (7) — — — —

Return of shares under share borrow

agreements ........................... — — (202,399,983) (202) — 202 — — — —

Balance at December 31, 2011 ............. 12,500,000 $13 3,753,201,929 $3,753 $ 71 $10,484,400 — $ — $ (9,784,092) $ 704,145

Comprehensive income, net of tax ........... — — — — 49 — — — 3,472,702 3,472,751

Issuance of common stock to employees and

employee benefit plans, net of forfeitures . . . — — 1,571,175 2 — 3,521 — — — 3,523

Share-based payment expense .............. — — — — — 60,299 — — — 60,299

Exercise of options ....................... — — 214,199,297 214 — 125,695 — — — 125,909

Cash dividends paid on common shares

($0.05) .............................. — — — — — (262,387) — — — (262,387)

Cash dividends paid on preferred shares on as-

converted basis ........................ — — — — — (64,675) — — — (64,675)

Conversion of preferred stock to common

stock ................................ (6,249,900) (7) 1,293,467,684 1,294 — (1,287) — — — —

Balance at December 31, 2012 ............. 6,250,100 $ 6 5,262,440,085 $5,263 $ 120 $10,345,566 — $ — $ (6,311,390) $ 4,039,565

Comprehensive income, net of tax ........... — — — — (428) — — — 377,215 376,787

Share-based payment expense .............. — — — — — 68,876 — — — 68,876

Exercise of options and vesting of restricted

stock units ........................... — — 32,841,381 32 — 19,396 — — — 19,428

Minimum withholding taxes on net share

settlement of stock-based compensation .... — — — — — (46,342) — — — (46,342)

Conversion of preferred stock to common

stock ................................ (6,250,100) (6) 1,293,509,076 1,293 — (1,287) — — — —

Conversion of Exchangeable Notes to common

stock ................................ — — 27,687,850 28 — 45,069 — — — 45,097

Common stock repurchased ................ — — — — — — 520,257,866 (1,764,969) — (1,764,969)

Common stock retired .................... — — (520,257,866) (520) — (1,764,449) (520,257,866) 1,764,969 — —

Initial fair value of forward contract ......... — — — — — 7,300 — — — 7,300

Balance at December 31, 2013 ............. — $— 6,096,220,526 $6,096 $ (308) $ 8,674,129 — $ — $ (5,934,175) $ 2,745,742

See accompanying notes to the consolidated financial statements.

F-6