XM Radio 2013 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

We provide Sirius XM Canada with chip sets and other services and we are reimbursed for these costs.

Sirius XM Canada declared dividends of $6,176 during the year ended December 31, 2012 which were not paid

until 2013.

We hold an investment in CAD $4,000 face value of 8% convertible unsecured subordinated debentures

issued by Sirius XM Canada for which the embedded conversion feature is bifurcated from the host contract. As

of December 31, 2013, the debentures are classified as a Related party current asset since they are expected to be

redeemed by Sirius XM Canada during the first quarter of 2014. The host contract is accounted for at fair value

as an available-for-sale security with changes in fair value recorded to Accumulated other comprehensive income

(loss), net of tax. The embedded conversion feature is accounted for at fair value as a derivative with changes in

fair value recorded in earnings as Interest and investment income.

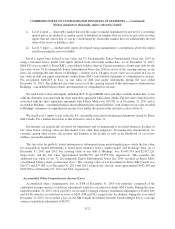

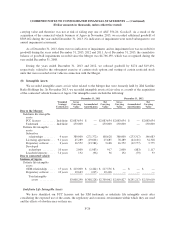

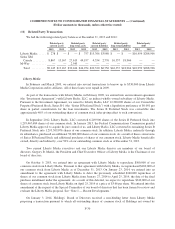

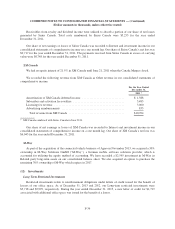

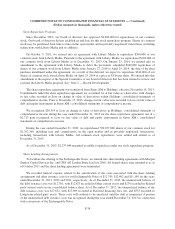

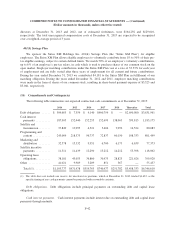

Related party long-term asset balances attributable to Sirius XM Canada consisted of the following:

December 31,

2013

December 31,

2012

Non-interest bearing note, principal ............................. $ 376 $ 404

Fair value of host contract of debenture .......................... — 3,877

Fair value of embedded derivative of debenture .................... — 9

Investment balance* .......................................... 26,972 37,983

Deferred programming costs and other receivables ................. 271 1,924

Total .................................................... $27,619 $44,197

* The investment balance included equity method goodwill and intangible assets of $26,161 and $27,615 as of December 31,

2013 and 2012, respectively.

We hold a non-interest bearing note issued by Sirius XM Canada. Our interest in Sirius XM Canada is

accounted for under the equity method. The excess of the cost of our ownership interest in the equity of Sirius

XM Canada over our share of the net assets is recognized as goodwill and intangible assets and is included in the

carrying amount of our investment. Equity method goodwill is not amortized. We periodically evaluate this

investment to determine if there has been an other than temporary decline below carrying value. Equity method

intangible assets are amortized over their respective useful lives, which is recorded in Interest and investment

income.

Sirius XM Canada declared quarterly dividends of $16,796 and $7,749 during the years ended December 31,

2013 and 2012, respectively, which were recorded as a reduction to our investment balance in Sirius XM Canada.

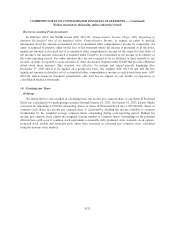

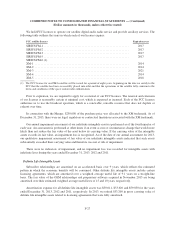

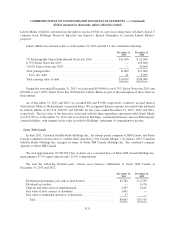

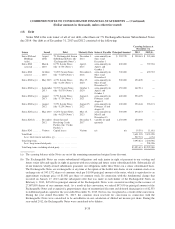

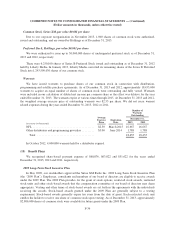

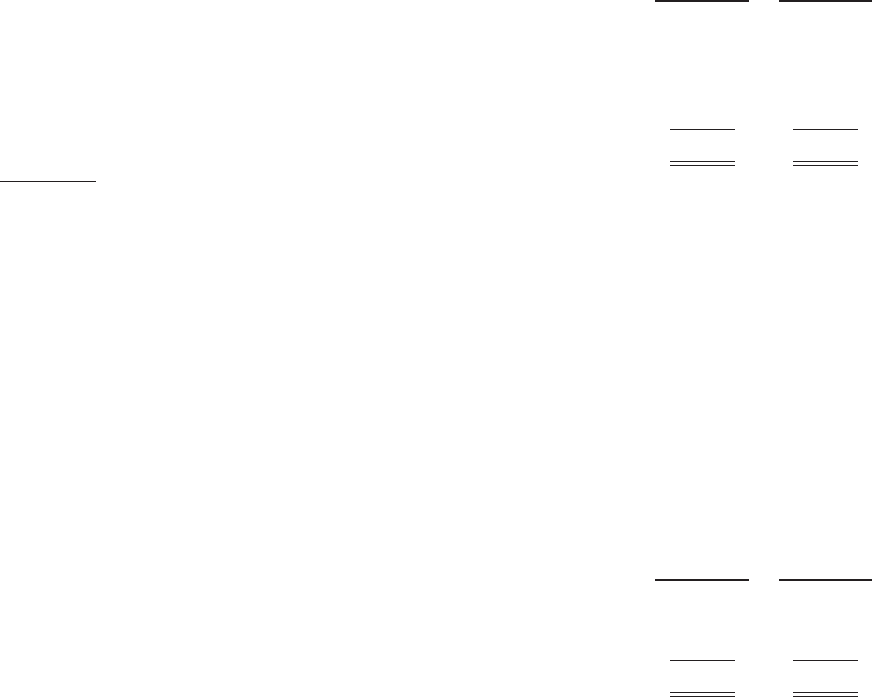

Related party liabilities attributable to Sirius XM Canada consisted of the following:

December 31,

2013

December 31,

2012

Deferred revenue for NHL licensing fees ......................... $ 1,500 $ —

Carrying value of deferred revenue .............................. 18,966 21,742

Deferred revenue for software licensing fees and other .............. 425 —

Total .................................................... $20,891 $21,742

In 2005, XM entered into agreements to provide XM Canada, now Sirius XM Canada, with the right to offer

XM satellite radio service in Canada. The agreements have an initial ten-year term, and Sirius XM Canada has

the unilateral option to extend the agreements for an additional five-year term. We receive a 15% royalty for all

subscriber fees earned by XM Canada each month for its basic service and an activation fee for each gross

F-32