XM Radio 2013 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• Our board of directors also considers specific risk topics throughout the year, including risks associated

with our business plan, operational efficiency, government regulation, physical facilities, information

technology infrastructure and capital structure, among many others. The board is informed about and

regularly discusses our risk profile, including legal, regulatory and operational risks to our business.

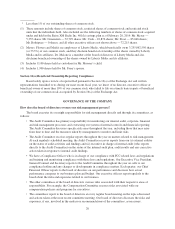

What are our policies and procedures for related party transactions?

We have adopted a written policy and written procedures for the review, approval and monitoring of

transactions involving the Company or its subsidiaries and “related persons.” For the purposes of the policy,

“related persons” include executive officers, directors or their immediate family members, or stockholders

owning five percent or greater of our common stock.

Our related person transaction policy requires:

• that any transaction in which a related person has a material direct or indirect interest and which exceeds

$120,000 (such transaction referred to as a “related person” transaction) and any material amendment or

modification to a related person transaction, be reviewed and approved or ratified by a committee of the

board composed solely of independent directors who are disinterested or by the disinterested members of

the board; and

• that any employment relationship or transaction involving an executive officer and the Company must be

approved by the Compensation Committee or recommended by the Compensation Committee to the

board for its approval.

In connection with the review and approval or ratification of a related person transaction, management must:

• disclose to the committee or disinterested directors, as applicable, the material terms of the related person

transaction, including the approximate dollar value of the amount involved in the transaction, and all the

material facts as to the related person’s direct or indirect interest in, or relationship to, the related person

transaction;

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

complies with the terms of our agreements governing our material outstanding indebtedness that limit or

restrict our ability to enter into a related person transaction;

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

will be required to be disclosed in our SEC filings. To the extent required to be disclosed, management

must ensure that the related person transaction is disclosed in accordance with SEC rules; and

• advise the committee or disinterested directors, as applicable, as to whether the related person transaction

constitutes a “personal loan” for purposes of Section 402 of the Sarbanes-Oxley Act of 2002.

In addition, the related person transaction policy provides that the Compensation Committee, in connection

with any approval or ratification of a related person transaction involving a non-employee director or director

nominee, should consider whether such transaction would compromise the director or director nominee’s status

as an “independent,” “outside,” or “non-employee” director, as applicable, under the rules and regulations of the

SEC, NASDAQ and Internal Revenue Code.

Except as described below, in 2013, there were no related party transactions that are required to be disclosed

pursuant to the SEC rules and regulations.

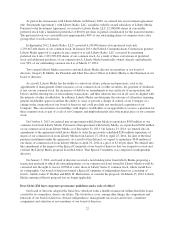

What is the relationship between Sirius XM and Liberty Media Corporation?

In February and March 2009, we entered into several transactions to borrow up to $530 million from Liberty

Media Corporation and its affiliates. All of these loans were repaid in cash in 2009.

21