XM Radio 2013 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

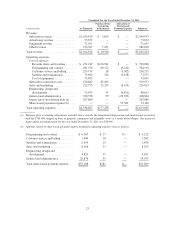

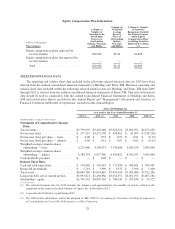

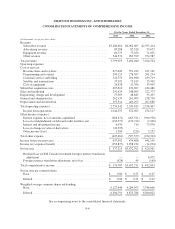

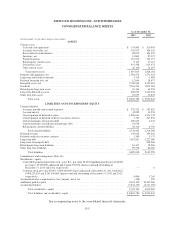

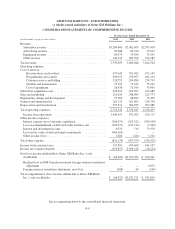

Sirius XM Radio Inc.

As of and for the Years Ended December 31,

2013 (1) (2) 2012 (3) 2011 2010 2009 (4)

(in thousands, except per share data)

Statements of Comprehensive Income

Data:

Total revenue ......................... $3,799,095 $3,402,040 $3,014,524 $2,816,992 $2,472,638

Net (loss) income attributable to Sirius XM

Radio Inc.’s stockholder .............. $ (66,494) $3,472,702 $ 426,961 $ 43,055 $ (538,226)

Cash dividends per share ................ $ — $ 0.05 $ — $ — $ —

Balance Sheet Data:

Cash and cash equivalents ............... $ 134,805 $ 520,945 $ 773,990 $ 586,691 $ 383,489

Restricted investments ................. $ 5,718 $ 3,999 $ 3,973 $ 3,396 $ 3,400

Total assets .......................... $8,851,496 $9,054,843 $7,495,996 $7,383,086 $7,322,206

Long-term debt, net of current portion ..... $3,093,821 $2,430,986 $3,012,351 $3,021,763 $3,063,281

Stockholder equity ..................... $2,301,346 $4,039,565 $ 704,145 $ 207,636 $ 95,522

(1) The selected financial data for 2013 includes the balances and approximately two months of activity related to the

acquisition of the connected vehicle business of Agero, Inc. in November 2013 and the fair value adjustments for debt

and equity related instruments.

(2) Net income per share for Sirius XM is not presented since Sirius XM is a wholly-owned subsidiary of Holdings.

(3) A special cash dividend was paid during 2012.

(4) The 2009 results and balances reflect the adoption of ASU 2009-15, Accounting for Own-Share Lending Arrangements

in Contemplation of Convertible Debt Issuance or Other Financing.

QUANTITATIVE AND QUALITATIVE DISCLOSURE ABOUT MARKET RISK

As of December 31, 2013, we did not hold or issue any free-standing derivatives. We hold investments in

marketable securities consisting of money market funds, certificates of deposit and investments in debt and

equity securities of other entities. We classify our investments in marketable securities as available-for-sale.

These securities are consistent with the objectives contained within our investment policy. The basic objectives

of our investment policy are the preservation of capital, maintaining sufficient liquidity to meet operating

requirements and maximizing yield.

Our debt includes fixed rate instruments and the fair market value of our debt is sensitive to changes in

interest rates. Our borrowings under the Senior Secured Revolving Credit Facility (the “Credit Facility”) carry a

variable interest rate based on LIBOR plus an applicable rate based on our debt to operating cash flow ratio.

Under our current policies, we do not use interest rate derivative instruments to manage our exposure to interest

rate fluctuations.

CHANGES IN AND DISAGREEMENTS WITH ACCOUNTANTS ON ACCOUNTING AND FINANCIAL

DISCLOSURE

None.

29