XM Radio 2013 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

focuses on practices relating to the cancellation of subscriptions; automatic renewal of subscriptions; charging,

billing, collecting, and refunding or crediting of payments from consumers; and soliciting customers.

A separate investigation into our consumer practices is being conducted by the Attorneys General of the

State of Florida and the State of New York. We are cooperating with these investigations and believe our

consumer practices comply with all applicable federal and state laws and regulations.

Other Matters. In the ordinary course of business, we are a defendant in various other lawsuits and

arbitration proceedings, including derivative actions; actions filed by subscribers, both on behalf of themselves

and on a class action basis; former employees; parties to contracts or leases; and owners of patents, trademarks,

copyrights or other intellectual property. None of these other actions are, in our opinion, likely to have a material

adverse effect on our business, financial condition or results of operations.

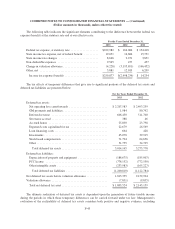

(17) Income Taxes

Holdings

There is no current U.S. federal income tax provision, as all federal taxable income was offset by utilizing

U.S. federal net operating loss carryforwards. The current state income tax provision is primarily related to

taxable income in certain states that have suspended the ability to use net operating loss carryforwards. The

current foreign income tax provision is primarily related to a reimbursement of foreign withholding taxes on

royalty income between us and our Canadian affiliate.

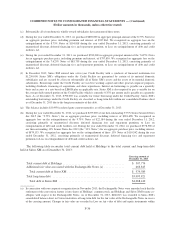

Holdings files a consolidated federal income tax return with its wholly-owned subsidiaries. Income tax

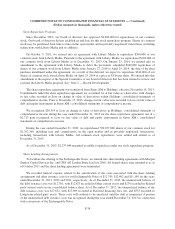

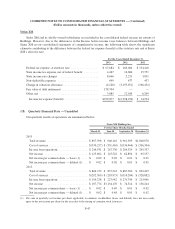

expense (benefit) attributable to Holdings consisted of the following:

For the Years Ended December 31,

2013 2012 2011

Current taxes:

Federal .......................................... $ — $ — $ —

State ............................................ 5,359 1,319 3,229

Foreign .......................................... (5,269) 2,265 2,741

Total current taxes ............................... 90 3,584 5,970

Deferred taxes:

Federal .......................................... 211,044 (2,729,823) 3,991

State ............................................ 48,743 (271,995) 4,273

Total deferred taxes .............................. 259,787 (3,001,818) 8,264

Total income tax expense (benefit) ................ $259,877 $(2,998,234) $14,234

F-44