XM Radio 2013 Annual Report Download - page 105

Download and view the complete annual report

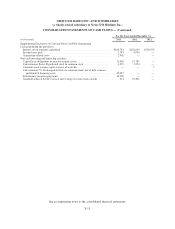

Please find page 105 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

Recent Accounting Pronouncements

In February 2013, the FASB issued ASU 2013-02, Comprehensive Income (Topic 220), Reporting of

Amounts Reclassified Out of Accumulated Other Comprehensive Income, to require an entity to provide

information about the amounts reclassified out of accumulated other comprehensive income by component. An

entity is required to present, either on the face of the statement where net income is presented or in the notes,

significant amounts reclassified out of accumulated other comprehensive income by the respective line items of

net income if the amount reclassified is required under GAAP to be reclassified to net income in its entirety in

the same reporting period. For other amounts that are not required to be reclassified in their entirety to net

income, an entity is required to cross-reference to other disclosures required under GAAP that provide additional

detail about those amounts. This standard was effective for interim and annual periods beginning after

December 15, 2012 and is to be applied on a prospective basis. We adopted ASU 2013-02 and will disclose

significant amounts reclassified out of accumulated other comprehensive income as such transactions arise. ASU

2013-02 affects financial statement presentation only and has no impact on our results of operations or

consolidated financial statements.

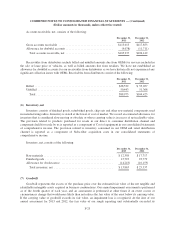

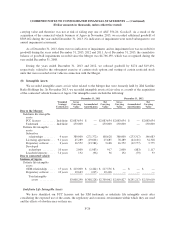

(4) Earnings per Share

Holdings

We utilize the two-class method in calculating basic net income per common share, as our Series B Preferred

Stock was considered to be participating securities through January 18, 2013. On January 18, 2013, Liberty Media

converted its remaining 6,250,100 outstanding shares of Series B Preferred Stock into 1,293,509,076 shares of

common stock. Basic net income per common share is calculated by dividing the income available to common

stockholders by the weighted average common shares outstanding during each reporting period. Diluted net

income per common share adjusts the weighted average number of common shares outstanding for the potential

dilution that could occur if common stock equivalents (convertible debt, preferred stock, warrants, stock options,

restricted stock awards and restricted stock units) were exercised or converted into common stock, calculated

using the treasury stock method.

F-23