XM Radio 2013 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

(11) Related Party Transactions

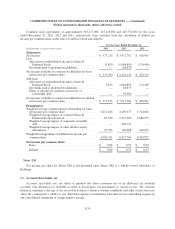

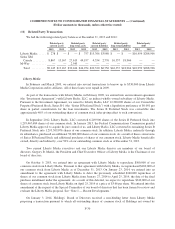

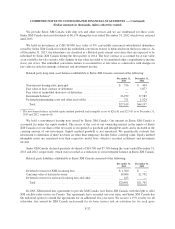

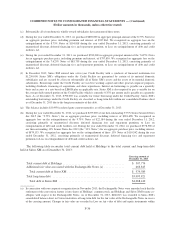

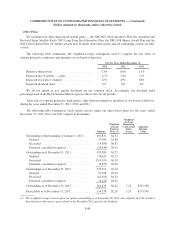

We had the following related party balances at December 31, 2013 and 2012:

Related party

current assets

Related party

long-term assets

Related party

current liabilities

Related party

long-term liabilities

Related party

debt

2013 2012 2013 2012 2013 2012 2013 2012 2013 2012

Liberty Media ..... $ 278 $ — $ — $ 757 $15,766 $3,980 $ — $ — $10,959 $208,906

Sirius XM

Canada ......... 8,867 13,167 27,619 44,197 4,554 2,776 16,337 18,966 — —

M-Way .......... — — 2,545 — — ———— —

Total .......... $9,145 $13,167 $30,164 $44,954 $20,320 $6,756 $16,337 $18,966 $10,959 $208,906

Liberty Media

In February and March 2009, we entered into several transactions to borrow up to $530,000 from Liberty

Media Corporation and its affiliates. All of these loans were repaid in 2009.

As part of the transactions with Liberty Media, in February 2009, we entered into an investment agreement

(the “Investment Agreement”) with Liberty Radio, LLC, an indirect wholly-owned subsidiary of Liberty Media.

Pursuant to the Investment Agreement, we issued to Liberty Radio, LLC 12,500,000 shares of our Convertible

Perpetual Preferred Stock, Series B-1 (the “Series B Preferred Stock”) with a liquidation preference of $0.001 per

share in partial consideration for the loan investments. The Series B Preferred Stock was convertible into

approximately 40% of our outstanding shares of common stock (after giving effect to such conversion).

In September 2012, Liberty Radio, LLC converted 6,249,900 shares of the Series B Preferred Stock into

1,293,467,684 shares of our common stock. In January 2013, the Federal Communications Commission granted

Liberty Media approval to acquire de jure control of us, and Liberty Radio, LLC converted its remaining Series B

Preferred Stock into 1,293,509,076 shares of our common stock. In addition, Liberty Media, indirectly through

its subsidiaries, purchased an additional 50,000,000 shares of our common stock. As a result of these conversions

of Series B Preferred Stock and additional purchases of shares of our common stock, Liberty Media beneficially

owned, directly and indirectly, over 50% of our outstanding common stock as of December 31, 2013.

Two current Liberty Media executives and one Liberty Media director are members of our board of

directors. Gregory B. Maffei, the President and Chief Executive Officer of Liberty Media, is the Chairman of our

board of directors.

On October 9, 2013, we entered into an agreement with Liberty Media to repurchase $500,000 of our

common stock from Liberty Media. Pursuant to that agreement with Liberty Media, we repurchased $160,000 of

our common stock from Liberty Media as of December 31, 2013. On January 23, 2014, we entered into an

amendment to the agreement with Liberty Media to defer the previously scheduled $240,000 repurchase of

shares of our common stock from Liberty Media from January 27, 2014 to April 25, 2014, the date of the final

purchase installment under the agreement. As a result of this deferral, we expect to repurchase $340,000 of our

shares of common stock from Liberty Media on April 25, 2014 at a price of $3.66 per share. We entered into this

amendment at the request of the Special Committee of our board of directors that has been formed to review and

evaluate the Liberty Media proposal. See “Note 1 — Recent Developments.”

On January 3, 2014, Holdings’ Board of Directors received a non-binding letter from Liberty Media

proposing a transaction pursuant to which all outstanding shares of common stock of Holdings not owned by

F-30