XM Radio 2013 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

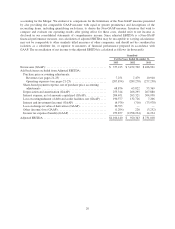

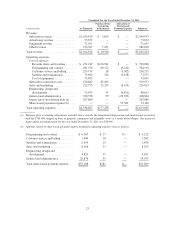

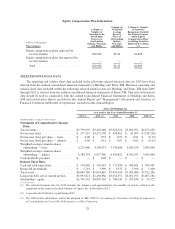

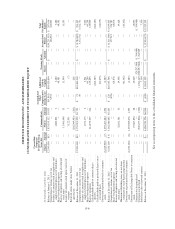

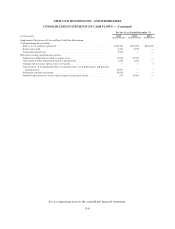

Equity Compensation Plan Information

(shares in thousands)

Plan Category

Column (a)

Number of

Securities to be

Issued upon

Exercise of

Outstanding

Options, Warrants

and Rights

Column (b)

Weighted-

Average

Exercise

Price of

Outstanding

Options,

Warrants

and Rights

Column (c) Number

of Securities

Remaining Available

for Future Issuance

under Equity

Compensation Plans

(excluding Securities

Reflected in Column

(a))

Equity compensation plans approved by

security holders ....................... 282,694 $2.43 82,806

Equity compensation plans not approved by

security holders ....................... — — —

Total ................................ 282,694 $2.43 82,806

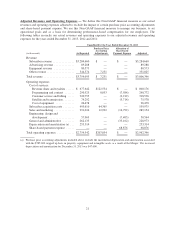

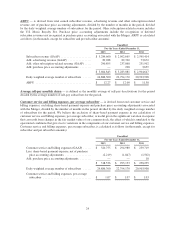

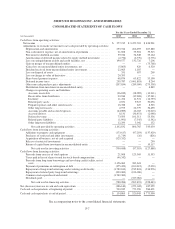

SELECTED FINANCIAL DATA

The operating and balance sheet data included in the following selected financial data for 2013 have been

derived from the audited consolidated financial statements of Holdings and Sirius XM. Historical operating and

balance sheet data included within the following selected financial data for Holdings and Sirius XM from 2009

through 2012 is derived from the audited consolidated financial statements of Sirius XM. This selected financial

data should be read in conjunction with the audited Consolidated Financial Statements of Holdings and Sirius

XM and related notes thereto included in this Annual Report and “Management’s Discussion and Analysis of

Financial Condition and Results of Operations” included in this Annual Report.

Sirius XM Holdings Inc.

As of and for the Years Ended December 31,

2013 (1) 2012 (2) 2011 2010 2009 (3)

(in thousands, except per share data)

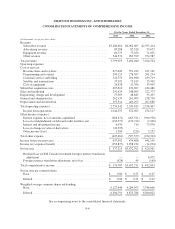

Statements of Comprehensive Income

Data:

Total revenue ......................... $3,799,095 $3,402,040 $3,014,524 $2,816,992 $2,472,638

Net income (loss) ..................... $ 377,215 $3,472,702 $ 426,961 $ 43,055 $ (538,226)

Net income (loss) per share — basic ....... $ 0.06 $ 0.55 $ 0.07 $ 0.01 $ (0.15)

Net income (loss) per share — diluted ..... $ 0.06 $ 0.51 $ 0.07 $ 0.01 $ (0.15)

Weighted average common shares

outstanding — basic ................. 6,227,646 4,209,073 3,744,606 3,693,259 3,585,864

Weighted average common shares

outstanding — diluted ................ 6,384,791 6,873,786 6,500,822 6,391,071 3,585,864

Cash dividends per share ................ $ — $ 0.05 $ — $ — $ —

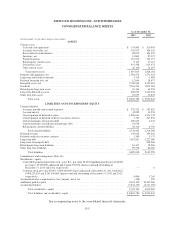

Balance Sheet Data:

Cash and cash equivalents ............... $ 134,805 $ 520,945 $ 773,990 $ 586,691 $ 383,489

Restricted investments ................. $ 5,718 $ 3,999 $ 3,973 $ 3,396 $ 3,400

Total assets .......................... $8,844,780 $9,054,843 $7,495,996 $7,383,086 $7,322,206

Long-term debt, net of current portion ..... $3,093,821 $2,430,986 $3,012,351 $3,021,763 $3,063,281

Stockholders’ equity ................... $2,745,742 $4,039,565 $ 704,145 $ 207,636 $ 95,522

(1) The selected financial data for 2013 includes the balances and approximately two months of activity related to the

acquisition of the connected vehicle business of Agero, Inc. in November 2013.

(2) A special cash dividend was paid during 2012.

(3) The 2009 results and balances reflect the adoption of ASU 2009-15, Accounting for Own-Share Lending Arrangements

in Contemplation of Convertible Debt Issuance or Other Financing.

28