XM Radio 2013 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

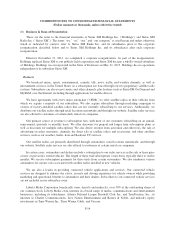

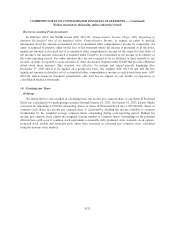

Common stock equivalents of approximately 365,177,000, 147,125,000 and 419,752,000 for the years

ended December 31, 2013, 2012 and 2011, respectively, were excluded from the calculation of diluted net

income per common share as the effect would have been anti-dilutive.

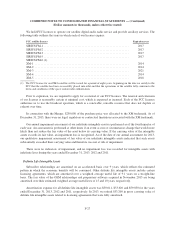

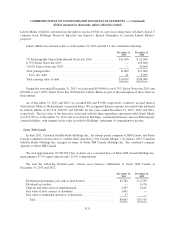

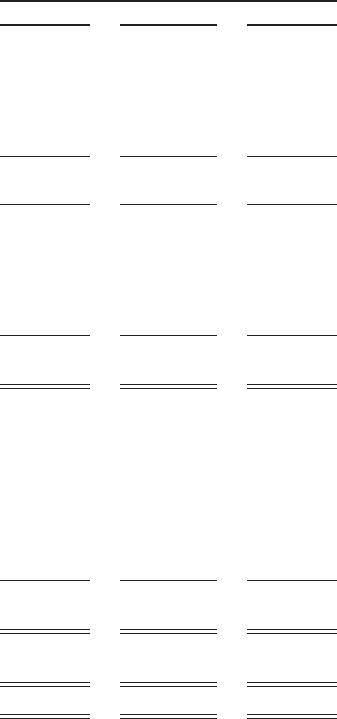

For the Years Ended December 31,

(in thousands, except per share data) 2013 2012 2011

Numerator:

Net income ..................................... $ 377,215 $ 3,472,702 $ 426,961

Less:

Allocation of undistributed income to Series B

Preferred Stock .............................. (3,825) (1,084,895) (174,449)

Dividends paid to preferred stockholders ........... — (64,675) —

Net income available to common stockholders for basic

net income per common share .................... $ 373,390 $ 2,323,132 $ 252,512

Add back:

Allocation of undistributed income to Series B

Preferred Stock .............................. 3,825 1,084,895 174,449

Dividends paid to preferred stockholders ........... — 64,675 —

Effect of interest on assumed conversions of

convertible debt ............................. — 38,500 —

Net income available to common stockholders for diluted

net income per common share .................... $ 377,215 $ 3,511,202 $ 426,961

Denominator:

Weighted average common shares outstanding for basic

net income per common share .................... 6,227,646 4,209,073 3,744,606

Weighted average impact of assumed Series B

Preferred Stock conversion .................... 63,789 2,215,900 2,586,977

Weighted average impact of assumed convertible

debt ....................................... — 298,725 —

Weighted average impact of other dilutive equity

instruments ................................. 93,356 150,088 169,239

Weighted average shares for diluted net income per

common share ................................ 6,384,791 6,873,786 6,500,822

Net income per common share:

Basic ........................................ $ 0.06 $ 0.55 $ 0.07

Diluted ...................................... $ 0.06 $ 0.51 $ 0.07

Sirius XM

Net income per share for Sirius XM is not presented since Sirius XM is a wholly-owned subsidiary of

Holdings.

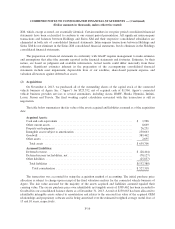

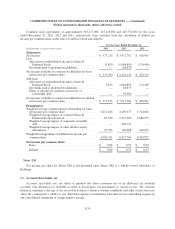

(5) Accounts Receivable, net

Accounts receivable, net, are stated at amounts due from customers net of an allowance for doubtful

accounts. Our allowance for doubtful accounts is based upon our assessment of various factors. We consider

historical experience, the age of the receivable balances, current economic conditions and other factors that may

affect the counterparty’s ability to pay. Bad debt expense is included in Customer service and billing expense in

our consolidated statements of comprehensive income.

F-24