XM Radio 2013 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

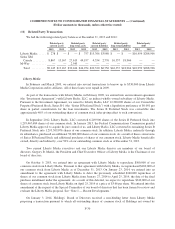

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

(c) Substantially all of our domestic wholly-owned subsidiaries have guaranteed these notes.

(d) During the year ended December 31, 2013, we purchased $800,000 in aggregate principal amount of the 8.75% Notes for

an aggregate purchase price, including premium and interest, of $927,860. We recognized an aggregate loss on the

extinguishment of the 8.75% Notes of $104,818 during the year ended December 31, 2013, consisting primarily of

unamortized discount, deferred financing fees and repayment premium, to Loss on extinguishment of debt and credit

facilities, net.

(e) During the year ended December 31, 2013, we purchased $700,000 in aggregate principal amount of the 7.625% Notes

for an aggregate purchase price, including premium and interest, of $797,830. We recognized an aggregate loss on the

extinguishment of the 7.625% Notes of $85,759 during the year ended December 31, 2013, consisting primarily of

unamortized discount, deferred financing fees and repayment premium, to Loss on extinguishment of debt and credit

facilities, net.

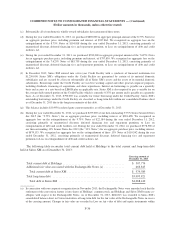

(f) In December 2012, Sirius XM entered into a five-year Credit Facility with a syndicate of financial institutions for

$1,250,000. Sirius XM’s obligations under the Credit Facility are guaranteed by certain of its material domestic

subsidiaries and are secured by a lien on substantially all of Sirius XM’s assets and the assets of its material domestic

subsidiaries. Borrowings under the Credit Facility are used for working capital and other general corporate purposes,

including dividends, financing of acquisitions and share repurchases. Interest on borrowings is payable on a quarterly

basis and accrues at a rate based on LIBOR plus an applicable rate. Sirius XM is also required to pay a variable fee on

the average daily unused portion of the Credit Facility which is currently 0.35% per annum and is payable on a quarterly

basis. As of December 31, 2013, $790,000 was available for future borrowing under the Credit Facility. Sirius XM’s

outstanding borrowings under the Credit Facility are classified as Long-term debt within our consolidated balance sheet

as of December 31, 2013 due to the long-term maturity of this debt.

(g) This balance includes $10,959 in related party current maturities as of December 31, 2013.

(h) During the year ended December 31, 2012, we purchased $257,000 of our then outstanding 9.75% Senior Secured Notes

due 2015 (the “9.75% Notes”) for an aggregate purchase price, including interest, of $281,698. We recognized an

aggregate loss on the extinguishment of the 9.75% Notes of $22,184 during the year ended December 31, 2012,

consisting primarily of unamortized discount, deferred financing fees and repayment premium, to Loss on

extinguishment of debt and credit facilities, net. During the year ended December 31, 2012, we purchased $778,500 of

our then outstanding 13% Senior Notes due 2013 (the “13% Notes”) for an aggregate purchase price, including interest,

of $879,133. We recognized an aggregate loss on the extinguishment of these 13% Notes of $110,542 during the year

ended December 31, 2012, consisting primarily of unamortized discount, deferred financing fees and repayment

premium, to Loss on extinguishment of debt and credit facilities, net.

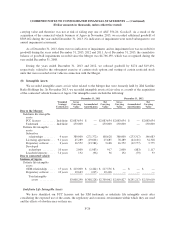

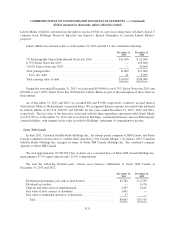

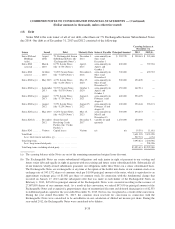

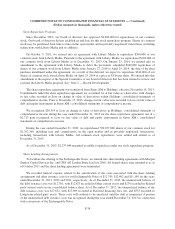

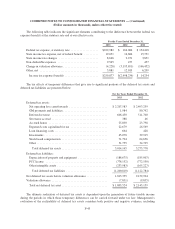

The following table reconciles total current debt held at Holdings to the total current and long-term debt

held at Sirius XM as of December 31, 2013:

Carrying amount at

December 31, 2013

Total current debt at Holdings .......................................... $ 507,774

Additional fair value associated with the Exchangeable Notes (a) .............. 466,815

Total current debt at Sirius XM ....................................... $ 974,589

Total long-term debt ................................................. $3,093,821

Total debt at Sirius XM ............................................. $4,068,410

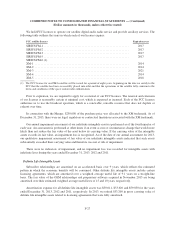

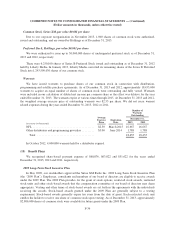

(a) In connection with our corporate reorganization in November 2013, the Exchangeable Notes were amended such that the

settlement of the conversion feature is into shares of Holdings’ common stock and Holdings and Sirius XM became co-

obligors with respect to the Exchangeable Notes. As of December 31, 2013, $466,815 was recorded to Sirius XM’s

consolidated balance sheet in Current maturities of long-term debt for the fair value of the Exchangeable Notes in excess

of the carrying amount. Changes in fair value are recorded in Loss on fair value of debt and equity instruments within

F-36