XM Radio 2013 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

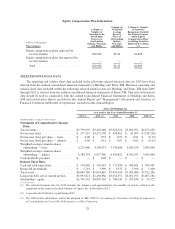

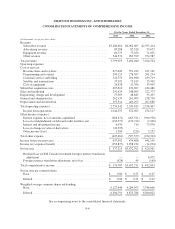

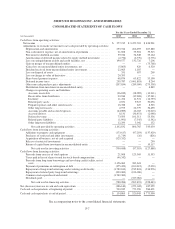

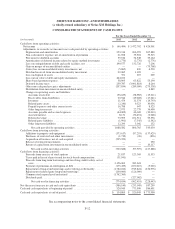

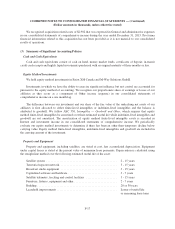

SIRIUS XM HOLDINGS INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

For the Years Ended December 31,

(in thousands) 2013 2012 2011

Cash flows from operating activities:

Net income ....................................................... $ 377,215 $ 3,472,702 $ 426,961

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation and amortization ...................................... 253,314 266,295 267,880

Non-cash interest expense, net of amortization of premium ................ 21,698 35,924 39,515

Provision for doubtful accounts ..................................... 39,016 34,548 33,164

Amortization of deferred income related to equity method investment ....... (2,776) (2,776) (2,776)

Loss on extinguishment of debt and credit facilities, net .................. 190,577 132,726 7,206

Gain on merger of unconsolidated entities ............................. — — (75,768)

(Gain) loss on unconsolidated entity investments, net .................... (5,865) 420 6,520

Dividend received from unconsolidated entity investment ................. 22,065 1,185 —

Loss on disposal of assets .......................................... 351 657 269

Loss on change in value of derivative ................................. 20,393 — —

Share-based payment expense ....................................... 68,876 63,822 53,190

Deferred income taxes ............................................. 259,787 (3,001,818) 8,264

Other non-cash purchase price adjustments ............................ (207,854) (289,050) (275,338)

Distribution from investment in unconsolidated entity .................... — — 4,849

Changes in operating assets and liabilities:

Accounts receivable ............................................ (36,189) (38,985) (13,211)

Receivables from distributors ..................................... 20,944 (19,608) (17,241)

Inventory ..................................................... 11,474 11,374 (14,793)

Related party assets ............................................. 2,031 9,523 30,036

Prepaid expenses and other current assets ............................ 16,788 647 8,525

Other long-term assets ........................................... 2,973 22,779 36,490

Accounts payable and accrued expenses ............................. (44,009) 46,043 (32,010)

Accrued interest ................................................ 8,131 (36,451) (2,048)

Deferred revenue ............................................... 73,593 101,311 55,336

Related party liabilities .......................................... (1,991) (7,545) (1,542)

Other long-term liabilities ........................................ 12,290 3,042 152

Net cash provided by operating activities .......................... 1,102,832 806,765 543,630

Cash flows from investing activities:

Additions to property and equipment ................................. (173,617) (97,293) (137,429)

Purchases of restricted and other investments ........................... (1,719) (26) (826)

Acquisition of business, net of cash acquired ........................... (525,352) — —

Release of restricted investments .................................... — — 250

Return of capital from investment in unconsolidated entity ................ — — 10,117

Net cash used in investing activities .............................. (700,688) (97,319) (127,888)

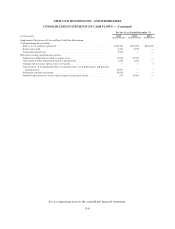

Cash flows from financing activities:

Proceeds from exercise of stock options ............................... 21,968 123,369 11,553

Taxes paid in lieu of shares issued for stock-based compensation ........... (46,342) — —

Proceeds from long-term borrowings and revolving credit facility, net of

costs ......................................................... 3,156,063 383,641 —

Payment of premiums on redemption of debt ........................... (175,453) (100,615) (5,020)

Repayment of long-term borrowings and revolving credit facility ........... (1,782,160) (915,824) (234,976)

Repayment of related party long-term borrowings ....................... (200,000) (126,000) —

Common stock repurchased and retired ............................... (1,762,360) — —

Dividends paid ................................................... — (327,062) —

Net cash used in financing activities .............................. (788,284) (962,491) (228,443)

Net (decrease) increase in cash and cash equivalents ......................... (386,140) (253,045) 187,299

Cash and cash equivalents at beginning of period ........................... 520,945 773,990 586,691

Cash and cash equivalents at end of period ................................. $ 134,805 $ 520,945 $ 773,990

See accompanying notes to the consolidated financial statements.

F-7