XM Radio 2013 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2013 XM Radio annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COMBINED NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — (Continued)

(Dollar amounts in thousands, unless otherwise stated)

Liberty Media would be converted into the right to receive 0.0760 of a new non-voting share of Liberty Series C

common stock. Holdings’ Board of Directors has formed a Special Committee to consider Liberty Media’s

proposal.

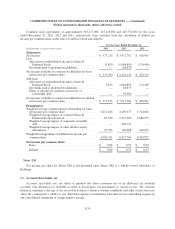

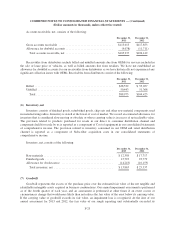

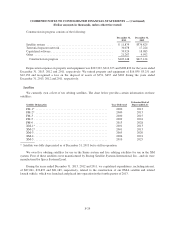

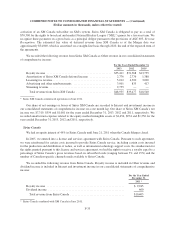

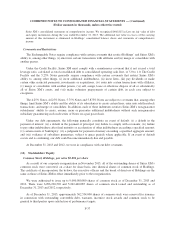

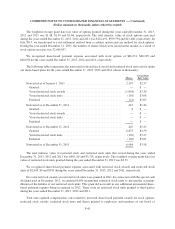

Liberty Media has advised us that as of December 31, 2013 and 2012 it also owned the following:

December 31,

2013

December 31,

2012

7% Exchangeable Senior Subordinated Notes due 2014 .............. $11,000 $ 11,000

8.75% Senior Notes due 2015 .................................. — 150,000

7.625% Senior Notes due 2018 ................................. — 50,000

Total principal debt .......................................... 11,000 211,000

Less: discounts ............................................ 41 2,094

Total carrying value of debt .................................... $10,959 $208,906

During the year ended December 31, 2013, we redeemed $150,000 of our 8.75% Senior Notes due 2015 and

$50,000 of our 7.625% Senior Notes due 2018 held by Liberty Media as part of the redemption of these Notes in

their entirety.

As of December 31, 2013 and 2012, we recorded $64 and $3,980, respectively, related to accrued interest

with Liberty Media to Related party current liabilities. We recognized Interest expense associated with debt held

by Liberty Media of $13,514, $30,931 and $35,681 for the years ended December 31, 2013, 2012 and 2011,

respectively. The fair value of the derivative associated with the share repurchase agreement with Liberty Media

was $15,702 as of December 31, 2013 and is recorded in Holdings’ consolidated balance sheet in Related party

current liabilities, with changes in fair value recorded to Holdings’ statements of comprehensive income.

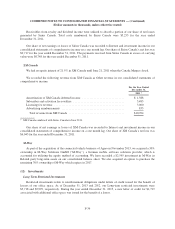

Sirius XM Canada

In June 2011, Canadian Satellite Radio Holdings Inc., the former parent company of XM Canada, and Sirius

Canada completed a transaction to combine their operations (“the Canada Merger”). In January 2013, Canadian

Satellite Radio Holdings Inc. changed its name to Sirius XM Canada Holdings Inc. The combined company

operates as Sirius XM Canada.

We own approximately 46,700,000 Class A shares on a converted basis of Sirius XM Canada Holdings Inc.

representing a 37.5% equity interest and a 25.0% voting interest.

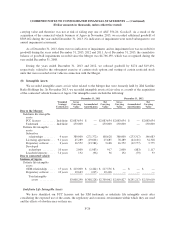

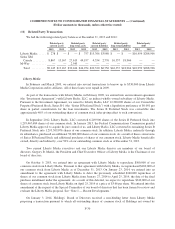

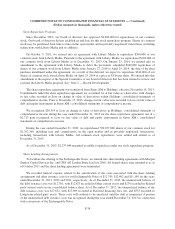

We had the following Related party current asset balances attributable to Sirius XM Canada at

December 31, 2013 and 2012:

December 31,

2013

December 31,

2012

Deferred programming costs and accrued interest .................. $2,782 $ 4,350

Dividends receivable ......................................... — 6,176

Chip set and other services reimbursement ........................ 2,387 2,641

Fair value of host contract of debenture .......................... 3,641 —

Fair value of embedded derivative of debenture .................... 57 —

Total .................................................... $8,867 $13,167

F-31