Seagate 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

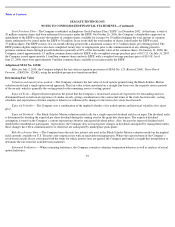

At June 27, 2008, the total compensation cost related to nonvested shares granted to employees under the Company’s stock option plans

(excluding nonvested shares exchanged in the Maxtor acquisition) but not yet recognized was approximately $7 million, net of estimated

forfeitures of approximately $1 million. This cost is being amortized on a straight-line basis over a weighted-

average remaining term of 2.1 years

and will be adjusted for subsequent changes in estimated forfeitures. In addition, the Company has additional stock-based compensation related

to nonvested shares exchanged in the Maxtor acquisition of approximately $7 million, which will be amortized over a weighted-average period

of approximately 1.8 years.

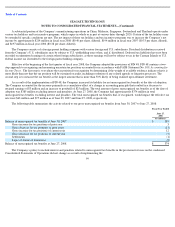

Performance Shares

At the Company

’

s 2007 Annual General Meeting on October 25, 2007, the Company

’

s shareholders approved the issuance of 925,000

performance shares to senior officers of the Company. Subject to continued employment, these performance shares will vest based upon the

achievement of certain earnings per share performance objectives as defined in the performance share agreements. The requisite service periods

for these awards do not commence until fiscal year 2009. As such, no compensation expense was recognized and no shares vested during fiscal

year 2008. During fiscal year 2008, 16,000 of these performance shares were

cancelled.

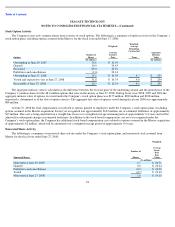

ESPP Information

During fiscal years 2008 and 2007, the aggregate intrinsic value of options exercised under the Company’s ESPP was $12 million and

$25 million, respectively. At June 27, 2008, the total compensation cost related to options to purchase the Company’s common shares under the

ESPP but not yet recognized was approximately $2 million. This cost will be amortized on a straight-line basis over a weighted-average period

of approximately 0.2 years.

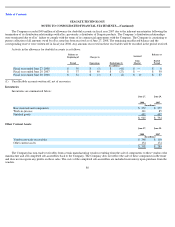

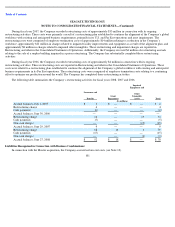

The following table shows the shares issued, and their respective weighted-average purchase price, pursuant to the ESPP during fiscal year

2008.

Deferred Compensation Plan

Number of

Shares

Weighted

-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(In millions)

(In Years)

(In millions)

Outstanding at June 27, 2008

1.9

$

16.56

0.2

$

5.6

Vested and expected to vest at June 27, 2008

1.9

$

16.56

0.2

$

5.6

January 31, 2008

July 31, 2007

Shares issued (in millions)

1.9

1.6

Weighted

-

average purchase price per share

$

17.23

$

19.98

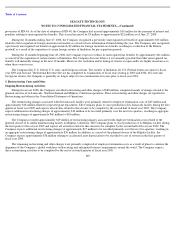

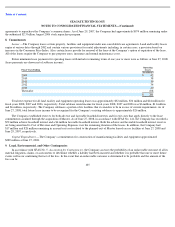

On January 1, 2001, the Company adopted a deferred compensation plan for the benefit of eligible employees. This plan is designed to

permit certain discretionary employer contributions, in excess of the tax limits applicable to the 401(k) plan and to permit employee deferrals in

excess of certain tax limits. Company assets earmarked to pay benefits under the plan are held by a rabbi trust. The Company has adopted the

provisions of EITF No. 97-14, Accounting for Deferred Compensation Arrangements Where Amounts Earned are Held in a Rabbi Trust and

Invested

(EITF 97-14). Under EITF 97-14, the assets and liabilities of a rabbi trust must be accounted for as assets and liabilities of the

Company. In addition all earnings and expenses of the rabbi

95