Seagate 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

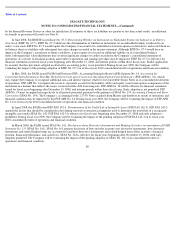

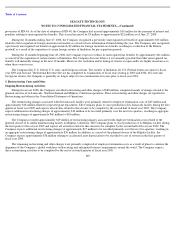

Revolving Credit Facility. HDD has a senior unsecured $500 million revolving credit facility that matures in September 2011. The credit

agreement that governs the Company’s revolving credit facility contains covenants that must be satisfied in order to remain in compliance with

the agreement. The credit agreement contains three financial covenants: (1) minimum cash, cash equivalents and marketable securities; (2) a

fixed charge coverage ratio; and (3) a net leverage ratio. As of June 27, 2008, the Company is in compliance with all covenants.

The $500 million revolving credit facility is available for cash borrowings and for the issuance of letters of credit up to a sub-limit of

$100 million. Although no borrowings have been drawn under this revolving credit facility to date, the Company had utilized $62 million for

outstanding letters of credit and bankers’ guarantees as of June 27, 2008, leaving $438 million for additional borrowings. The credit agreement

governing the revolving credit facility includes limitations on the ability of the Company to pay dividends, including a limit of $300 million in

any four consecutive quarters.

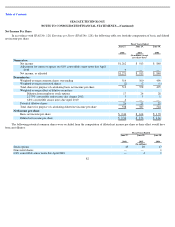

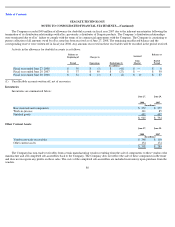

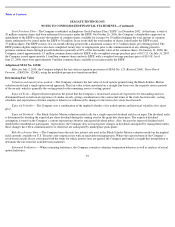

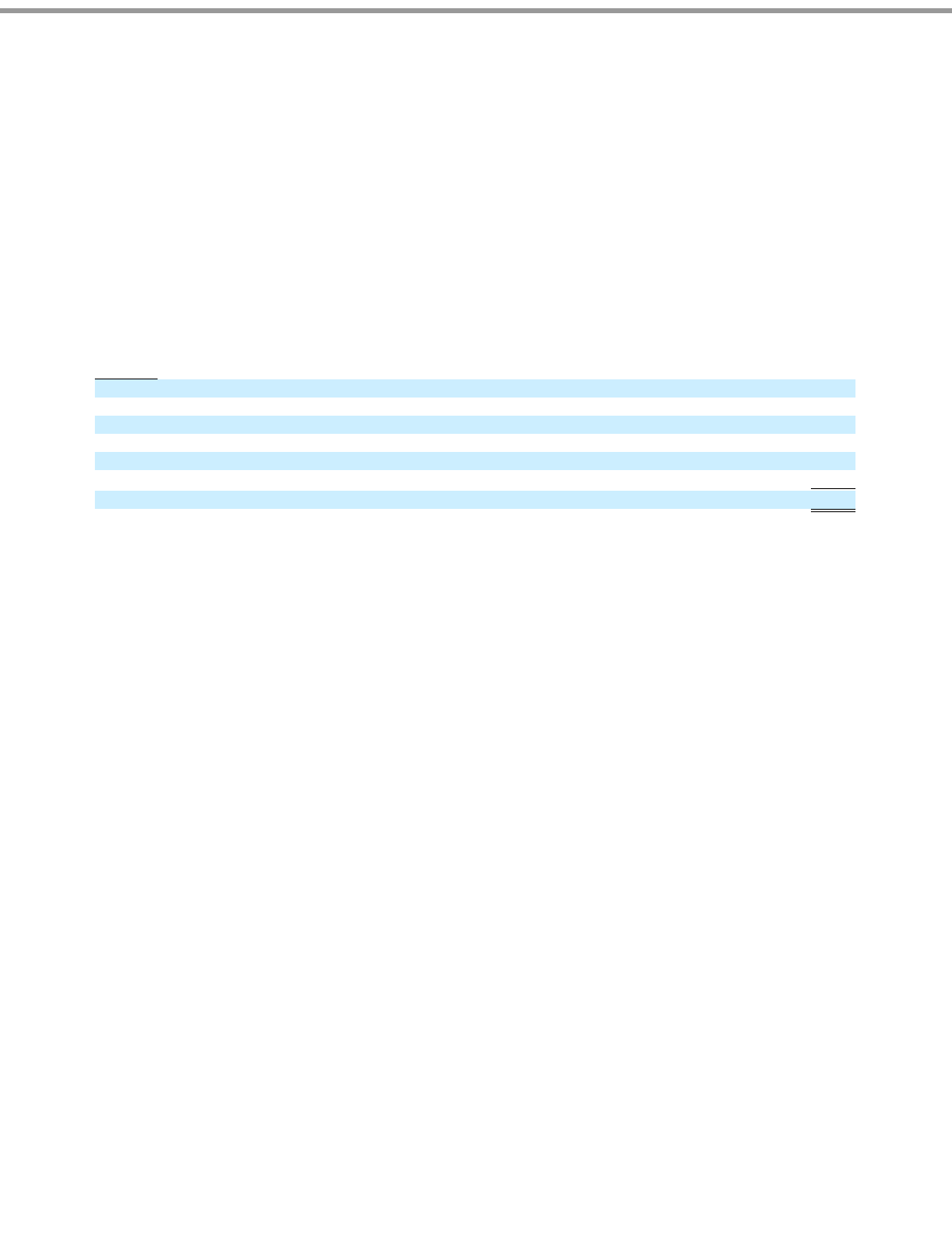

At June 27, 2008, future minimum principal payments on long-term debt were as follows (in millions):

Included in future minimum principal payments on long-term debt for fiscal year 2009 is the principal amount of $326 million related to

our 2.375% Notes, which are payable upon conversion and are currently convertible, as the Company’s share price was in excess of 110% of the

conversion price for at least 20 consecutive trading days during the last 30 trading days of the fourth quarter of fiscal year 2008. Unless earlier

converted, the 2.375% Notes must be redeemed in August 2012.

3. Compensation

Fiscal Year

2009

$

361

2010

441

2011

5

2012

630

2013

—

Thereafter

600

$

2,037

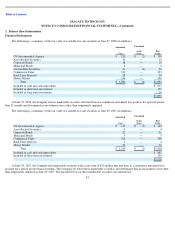

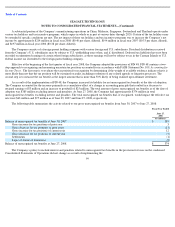

Tax

-

Deferred Savings Plan

The Company has a tax-deferred savings plan, the Seagate 401(k) Plan (“the 40l(k) plan”), for the benefit of qualified employees. The 40l

(k) plan is designed to provide employees with an accumulation of funds at retirement. Qualified employees may elect to make contributions to

the 401(k) plan on a monthly basis. Pursuant to the 401(k) plan, the Company matches 50% of employee contributions, up to 6% of

compensation, subject to maximum annual contributions of $2,500 per participating employee. During fiscal years 2008, 2007 and 2006, the

Company made matching contributions of $15 million, $15 million and $13 million, respectively.

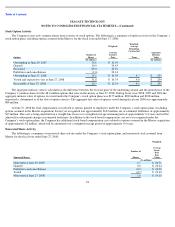

Stock-Based Benefit Plans

The Company’s stock-based benefit plans have been established to promote the Company’s long-term growth and financial success by

providing incentives to its employees, directors, and consultants through grants of share-based awards. The provisions of the Company’s stock-

based benefit plans, which allow for the grant of various types of equity-

based awards, are also intended to provide greater flexibility to maintain

the Company’s competitive ability to attract, retain and motivate participants for the benefit of the Company and its shareholders.

90