Seagate 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

Seasonality

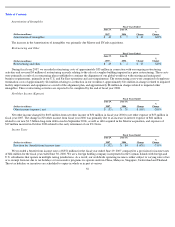

Historically, we have exhibited seasonally lower unit demand during the second half of each fiscal year, however, there were some recent

quarters in fiscal year 2006 in which these seasonal trends were moderated. We saw a return to traditional seasonality in fiscal year 2007 and

fiscal year 2008. For the September 2008 quarter, we expect to see demand in the desktop, mobile and CE markets to be seasonally higher than

the June 2008 quarter, while we expect demand in the enterprise market to be flat to slightly up compared to the June 2008 quarter.

Recording Heads and Media

The percentage of our requirements for recording media that we produce internally varies from quarter to quarter. Our long

-

term strategy is

to externally purchase approximately 10% of total recording media requirements. In July 2008, we announced the proposed closure of our

recording media manufacturing facility in Milpitas, California. The closure is part of our ongoing focus on cost-efficiencies in all areas of our

business. We plan to cease production at the Milpitas manufacturing facility in October 2008. We are continuing to expand our recording media

production facilities in Singapore. We expect meaningful output from our new media facility in Singapore beginning the first quarter of fiscal

year 2009 and we believe we will have adequate internal and external supply plans in place to support our requirements. Similar to our long

-

term

strategy on recording media supply, our future plans include the evaluation and external purchase of up to 10% of recording heads requirements.

We purchase all of our glass substrates from third parties (mainly in Japan), which are used to manufacture our disc drives for mobile and

small form factor CE products. Historically, we purchase approximately 70% of our aluminum substrates for recording media production from

third parties. In December 2007, we announced the proposed closure of our substrate manufacturing facility in Limavady, Northern Ireland. The

proposed closure is part of our ongoing focus on cost-efficiencies in all areas of our business. We plan to cease production at our Limavady

facility during the first quarter of fiscal year 2009. We are in the process of adding an aluminum substrate manufacturing facility in Johor,

Malaysia which will allow us to be more cost competitive and position us for future expansion, and reduce our external substrate purchases to

approximately 50%. We expect meaningful output from our Johor facility in during the first quarter of fiscal year 2009.

Commodity and Other Manufacturing Costs

The production of disc drives requires precious metals, scarce alloys and industrial commodities, that are subject to fluctuations in prices,

and the supply of which has at times been constrained. Recent increases in the price of many commodities have resulted in higher material costs

for our products. Additionally, adverse economic conditions such as rising fuel costs may further increase our costs related to commodities,

manufacturing and freight. Should we not be able to pass these increased costs onto our customers, our gross margins may be impacted.

In order to mitigate susceptibility to these conditions, we may maintain increased inventory of precious metals, scarce alloys and industrial

commodities. In addition, we have increased our use of ocean shipments to help offset the increase in freight costs.

Capital Investments

In fiscal year 2008, we made $930 million of capital investments, $293 million of which we incurred in the June 2008 quarter. For fiscal

year 2009, we expect approximately $1 billion in capital investment will be required to ensure continued alignment of our manufacturing

capacity with customer demand and to finish our planned recording media and substrate capacity expansions in Asia, while we continue to

improve our use of capital equipment.

48