Seagate 2007 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

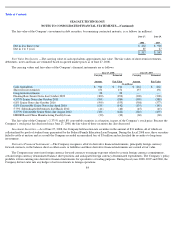

Inventory —Inventories are valued at the lower of cost (which approximates actual cost using the first-in, first-out method) or market.

Market value is based upon an estimated average selling price reduced by estimated cost of completion and disposal.

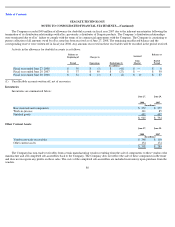

Property, Equipment, and Leasehold Improvements —Land, equipment, buildings and leasehold improvements are stated at cost. The cost

basis of assets acquired in the Maxtor business combination was based on estimated fair values at the date of acquisition (see Note 10).

Equipment and buildings are depreciated using the straight-line method over the estimated useful lives of the assets. Leasehold improvements

are amortized using the straight-line method over the shorter of the estimated life of the asset or the remaining term of the lease. The cost of

additions and substantial improvements to property, equipment and leasehold improvements are capitalized. The cost of maintenance repairs to

property, equipment and leasehold improvements is expensed as incurred.

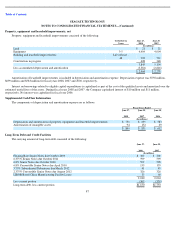

Goodwill and Other Intangibles Assets —The Company accounts for goodwill and other intangible assets in accordance with

SFAS No. 142. Goodwill represents the excess of the purchase price over the fair value of the net tangible and identifiable intangible assets

acquired in a business combination, and is not subject to amortization. In accordance with SFAS No. 142, the Company tests goodwill for

impairment at least annually, or more frequently if events and circumstances warrant.

Intangible assets resulting from the acquisitions of entities accounted for using the purchase method of accounting are estimated by

management based on the fair value of assets received. SFAS No. 142 also requires that intangible assets with finite useful lives be amortized

over their respective estimated useful lives. The Company’s acquisition-related intangible assets are comprised of existing technology, customer

relationships, trade names, and other intangible assets and are amortized over periods ranging from one to four years on a straight-line basis.

SFAS No. 142 further requires that intangible assets be reviewed for impairment in accordance with SFAS No. 144, Accounting for the

Impairment or Disposal of Long

-Lived Assets (SFAS No. 144).

Allowances for Doubtful Accounts —The Company maintains an allowance for uncollectible accounts receivable based upon expected

collectability. This reserve is established based upon historical trends, current economic conditions and an analysis of specific exposures. The

provision for doubtful accounts is recorded as a charge to general and administrative expense (see Note 2).

Advertising Expense —The cost of advertising is expensed as incurred. Advertising costs were approximately $55 million, $51 million and

$40 million in fiscal years 2008, 2007 and 2006, respectively.

Stock-Based Compensation —Effective July 2, 2005, the Company adopted the fair value recognition provisions of SFAS No. 123

(Revised 2004), Share-Based Payment , (SFAS No. 123(R)), using the modified-prospective-transition method. The Company has included

stock-based compensation costs in its results of operations for fiscal years 2008, 2007 and 2006 (see Note 3). The adoption of SFAS No. 123(R)

had a material impact on the Company’s results of operations. The Company has elected to apply the with-and-without method to assess the

realization of excess tax benefits.

Foreign Currency Remeasurement and Translation —The U.S. dollar is the functional currency for all of the Company’s foreign

operations. Monetary assets and liabilities denominated in foreign currencies are remeasured into U.S. dollars at current exchange rates. The

gains and losses from the remeasurement of foreign currency denominated balances into U.S. dollars are included in net income (loss) for those

operations.

78