Seagate 2007 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

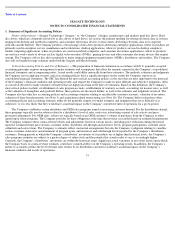

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

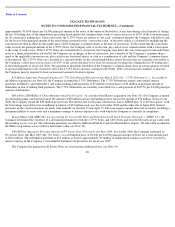

by the Internal Revenue Service or other tax jurisdiction. If estimates of these tax liabilities are greater or less than actual results, an additional

tax benefit or provision will result (see Note 4).

In June 2008, FASB EITF issued Issue No. 07-5, Determining Whether an Instrument (or Embedded Feature) Is Indexed to an Entity’s

Own Stock (EITF No. 07-5). EITF No. 07-5 addresses the determination of whether an instrument (or an embedded feature) is indexed to an

entity’s own stock. EITF No. 07-

5 would require the Company to account for its embedded conversion options as derivatives and record them on

its balance sheet as a liability with subsequent fair value changes recorded in the income statement. Although EITF No. 07-5 would have no

impact on the Company’s actual past or future cash flows, it may require it to record an additional liability on its consolidated balance

sheet. Subsequent fair value adjustments may result in significant charges or credits recorded in the Company’s consolidated statement of

operations. As a result, its financial position and results of operations and earnings per share may be impacted. EITF No. 07-5 is effective for

financial statements issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Earlier application

by an entity that has previously adopted an alternative accounting policy is not permitted. During fiscal year 2009, the Company will be

evaluating the impact of the pending adoption of EITF No. 07-

5 on its fiscal year 2010 consolidated results of operations and financial condition.

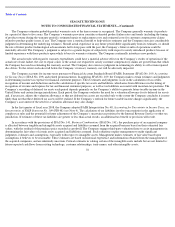

In May 2008, the FASB issued FASB Staff Position (FSP), Accounting Principles Board (APB) Opinion No. 14, Accounting for

Convertible Debt Instruments That May Be Settled in Cash upon Conversion (Including Partial Cash Settlement ) (FSP APB No. 14), which,

may require the Company to recognize additional non-

cash interest expense related to its Convertible Senior Notes in its consolidated statements

of operations. FSP APB No. 14 requires the issuer to separately account for the liability (debt) and equity (conversion option) components of the

instrument in a manner that reflects the issuer’s nonconvertible debt borrowing rate. FSP APB No. 14 will be effective for financial statements

issued for fiscal years beginning after December 15, 2008, and interim periods within those fiscal years. Early adoption is not permitted. FSP

APB No. 14 must be applied retrospectively to all periods presented pursuant to the guidance of SFAS No. 154, Accounting Changes and Error

Corrections (SFAS No. 154). The Company’s accounting for the 2.375% Notes acquired from Maxtor and therefore its results of operations and

financial condition may be impacted by this FSP APB No. 14. During fiscal year 2009, the Company will be evaluating the impact of FSP APB

No. 14 on its fiscal year 2010 consolidated results of operations and financial condition.

In April 2008, the FASB issued FSP FAS 142-3, Determination of the Useful Life of Intangible Assets (FSP FAS 142-3). FSP FAS 142-3

amends the factors that should be considered in developing renewal or extension assumptions used to determine the useful life of a recognized

intangible asset under SFAS No. 142. FSP FAS 142-3 is effective for fiscal years beginning after December 15, 2008 and early adoption is

prohibited. During fiscal year 2009, the Company will be evaluating the impact of the pending adoption of FSP FAS 142-3 on its fiscal year

2010 consolidated results of operations and financial condition.

In March 2008, the FASB issued SFAS No. 161,

Disclosures about Derivative Instruments and Hedging Activities, an amendment of FASB

Statement No. 133 (SFAS No. 161). SFAS No. 161 requires disclosure of how and why an entity uses derivative instruments, how derivative

instruments and related hedged items are accounted for and how derivative instruments and related hedged items affect an entity’s financial

position, financial performance, and cash flows. SFAS No. 161 is effective for fiscal years beginning after November 15, 2008, with early

adoption permitted. The Company will be evaluating the impact of the pending adoption of SFAS No. 161 on its consolidated results of

operations and financial condition.

80