Seagate 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

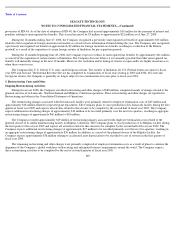

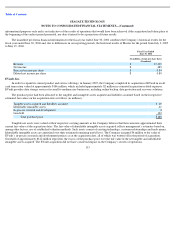

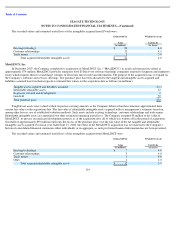

Other Matters

The Company is involved in a number of other judicial and administrative proceedings incidental to its business, and it may be involved in

various legal proceedings arising in the normal course of its business in the future. Although occasional adverse decisions or settlements may

occur, the Company believes that the final disposition of such matters will not have a material adverse effect on its financial position or results of

operations.

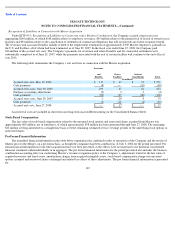

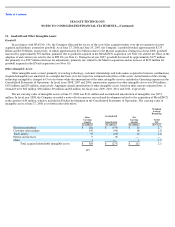

10. Acquisitions

Maxtor Corporation

On December 20, 2005, the Company entered into an Agreement and Plan of Merger (the “Merger Agreement”) with Maxtor Corporation,

a Delaware corporation, and MD Merger Corporation, a Delaware corporation and direct wholly-

owned subsidiary of Seagate, by which Seagate

agreed to acquire Maxtor (the “Merger”), and whereby Maxtor would become a wholly owned subsidiary of Seagate. On May 19, 2006, the

Company completed the acquisition of Maxtor in a stock-for-stock transaction. The acquisition was structured to qualify as a tax-free

reorganization and the Company has accounted for the acquisition in accordance with SFAS No. 141. The purpose of the acquisition was to

enhance the Company’s scale and capacity to better drive technology advances and accelerate delivery of a wide range of differentiated products

and cost-effective solutions to a growing base of customers.

Under the terms of the Merger Agreement, each share of Maxtor common stock was exchanged for 0.37 of the Company’s common

shares. The Company issued approximately 96.9 million common shares to Maxtor’s shareholders, assumed and converted Maxtor options

(based on the 0.37 exchange ratio) into options to purchase approximately 7.1 million of the Company’s common shares and assumed and

converted all outstanding Maxtor nonvested stock into approximately 1.3 million of the Company’s nonvested shares. The purchase

consideration comprising the fair value of the common shares, stock options and nonvested shares assumed and including transaction costs was

approximately $2.0 billion, excluding assumption by the Company of Maxtor’s approximate $576 million of outstanding debt obligations.

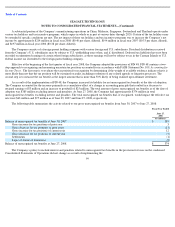

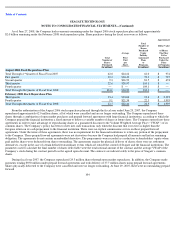

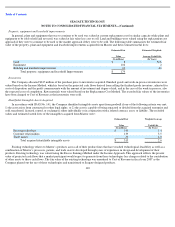

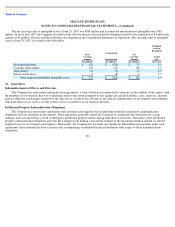

Purchase Price Allocation

The application of purchase accounting under SFAS No. 141 requires that the total purchase price be allocated to the fair value of assets

acquired and liabilities assumed based on their fair values at the acquisition date, with amounts exceeding the fair values being recorded as

goodwill. The allocation process requires an analysis and valuation of acquired assets, including fixed assets, technologies, customer contracts

and relationships, trade names and liabilities assumed, including contractual commitments and legal contingencies.

The Company identified and recorded the assets, including specifically identifiable intangible assets, and liabilities assumed from Maxtor

at their estimated fair values as at May 19, 2006, the date of acquisition, and allocated the residual value of approximately $2.2 billion to

goodwill, including $297 million of net adjustments recorded during fiscal year ended June 29, 2007. These net adjustments which reduced

goodwill were primarily due to the reversal of part of the valuation allowance previously recorded as of the acquisition date against certain

deferred tax assets comprised of former Maxtor operating losses (see Note 4 and Note 11).

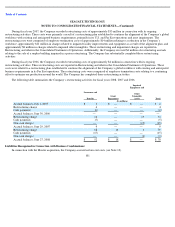

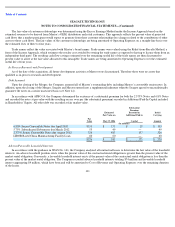

Determination of Fair Values

The Company assigned fair values to all the assets and liabilities assumed as of May 19, 2006. For certain tangible and intangible assets

acquired and liabilities assumed, the Company utilized the assistance of a third party valuation firm in accordance with SFAS No. 141.

109