Seagate 2007 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2007 Seagate annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

SEAGATE TECHNOLOGY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

—

(

Continued)

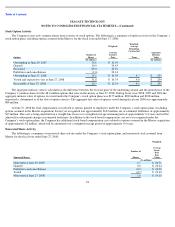

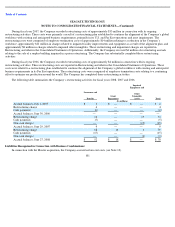

Stock Option Activity

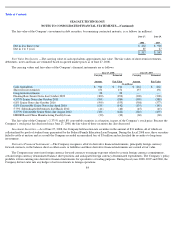

The Company issues new common shares upon exercise of stock options. The following is a summary of option activity for the Company

’

s

stock option plans, including options assumed from Maxtor, for the fiscal year ended June 27, 2008:

The aggregate intrinsic value is calculated as the difference between the exercise price of the underlying awards and the quoted price of the

Company’s common shares for the 28.0 million options that were in-the-money at June 27, 2008. During fiscal years 2008, 2007 and 2006 the

aggregate intrinsic value of options exercised under the Company’s stock option plans was $155 million, $280 million and $228 million,

respectively, determined as of the date of option exercise. The aggregate fair value of options vested during fiscal year 2008 was approximately

$84 million.

At June 27, 2008 the total compensation cost related to options granted to employees under the Company’s stock option plans (excluding

options assumed in the Maxtor acquisition) but not yet recognized was approximately $122 million, net of estimated forfeitures of approximately

$17 million. This cost is being amortized on a straight-line basis over a weighted-average remaining term of approximately 2.3 years and will be

adjusted for subsequent changes in estimated forfeitures. In addition to the stock-based compensation cost not yet recognized under the

Company’s stock option plans, the Company has additional stock-

based compensation costs related to options assumed in the Maxtor acquisition

of approximately $2 million, which will be amortized over a weighted-average period of approximately 0.9 years.

Nonvested Share Activity

Options

Number of

Shares

Weighted

-

Average

Exercise

Price

Weighted-

Average

Remaining

Contractual

Term

Aggregate

Intrinsic

Value

(In millions)

(In millions)

Outstanding at June 29, 2007

56.6

$

10.94

Granted

10.0

24.43

Exercised

(10.0

)

10.94

Forfeitures and cancellations

(1.6

)

22.14

Outstanding at June 27, 2008

55.0

$

10.38

4.7

$

255

Vested and expected to vest at June 27, 2008

51.8

$

16.74

4.6

$

254

Exercisable at June 27, 2008

29.5

$

12.34

4.1

$

235

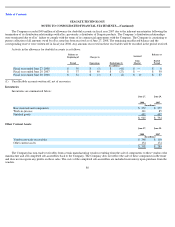

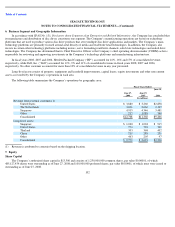

The following is a summary of nonvested share activity under the Company

’

s stock option plans, and nonvested stock assumed from

Maxtor for the fiscal year ended June 27, 2008:

94

Nonvested Shares

Number of

Shares

Weighted

-

Average

Grant-

Date

Fair

Value

(In millions)

Nonvested at June 29, 2007

1.7

$

20.71

Granted

0.2

$

22.24

Forfeitures and cancellations

(0.2

)

$

22.00

Vested

(0.7

)

$

21.40

Nonvested at June 27, 2008

1.0

$

19.10